Inaccessible loans and insurance - why are Azerbaijani farmers deprived of financial support?

Credit and insurance problems of farmers

The unavailability of loans for farmers in Azerbaijan and the lack of information about insurance options make farmers helpless in the slightest emergency and reduces production. Although the state promises new opportunities, in reality they are useless. “Compared to neighboring Georgia and Armenia, the percentage of loans allocated for agriculture is two times less than ours. If there this figure is six to seven percent, then in our country it is close to 20 percent,” says a local expert.

- The Venice Commission rejects Georgian bill “On Deoligarchization”

- More cases of elder abuse in Armenia

- “The number of taxis will be limited, prices will increase” – Azerbaijani Transport Minister

Active discussions are underway with the Ministry of Agriculture on loans, Chairman of the Central Bank Taleh Kazymov said at a commission meeting held in the Milli Majlis. According to him, new rules on agricultural loans are being prepared and collateral requirements are being reviewed:

“We will take mitigating measures in a balanced manner, taking into account the risks.”

Today various banks in Azerbaijan provide agricultural loans at the expense of the Agency for Agricultural Credit and Development. The interest rate on these loans is 7-12 per year. The loan amount varies between 1,000-20,000 manats [about $590-11,750], and the term is one, three and five years.

One of the main conditions for granting a loan is that at least 30 percent of the amount of the submitted project must be the entrepreneur’s own funds. In addition, the borrower must have liquid collateral.

“…I wanted to get a loan”

Ismail Akhmedov, a farmer living in Tovuz, told Radio Azadlyg that although he wants to expand his business, he has been unable to do so for a long time.

“I am engaged in growing potatoes, from each hectare you can get 35 tons of potatoes. I have additional land and want to expand my production. However, thinking that I could not do it with my own money, I decided to take out a loan. I was given such conditions that I ran away.”

According to him, the interest on the loan is high, and a lot of documents are required.

Deputy: “The issue is being resolved”

It was not possible to talk with the Central Bank, the Ministry of Agriculture and other relevant structures.

But Rufat Guliyev, a member of the Committee on Economic Policy, Industry and Entrepreneurship of the Milli Majlis, told Turan that it is planned to create separate micro and small credit lines for agriculture:

“We had such projects even during the coronavirus pandemic. At that time, quick loans were issued up to 15,000 manats [about $8,820]. Also, the conditions of the pledge were very favorable for the farmers. A broader package is planned in this direction. Even the amount of the loan issued may increase, and the interest will be minimal. The issue is being resolved.”

According to the deputy, the main issue is the duration of the loan: “Agricultural loans should be disbursed within 10-15 days. Because the weather won’t wait. The expected changes will be acceptable and convenient for both the state and the market, and entrepreneurs.”

“Compared to neighboring Georgia and Armenia…”

Previously, loans in Azerbaijan were in many cases issued to close friends and relatives of officials involved in agriculture, agricultural expert Vahid Maharramov told Radio Azadlyg.

According to him, in general the interest rate on loans allocated with or without collateral is in reality very high: “Compared to neighboring Georgia and Armenia, interest rates on loans allocated to agriculture are two times lower than ours. There, this figure is six to seven percent, we have about 20 percent.”

He stressed that the second problem is the low productivity of agriculture in Azerbaijan: “Since productivity is low, costs are high, and the incomes of our villagers are low. They are unable to pay bank interest on their income. On the other hand, there are more serious problems in the country’s agriculture. This is the high cost and inaccessibility of the means of production for the farmers.”

There is insurance, and there isn’t

Experts say that farmers cannot afford agricultural insurance, serious reforms are needed.

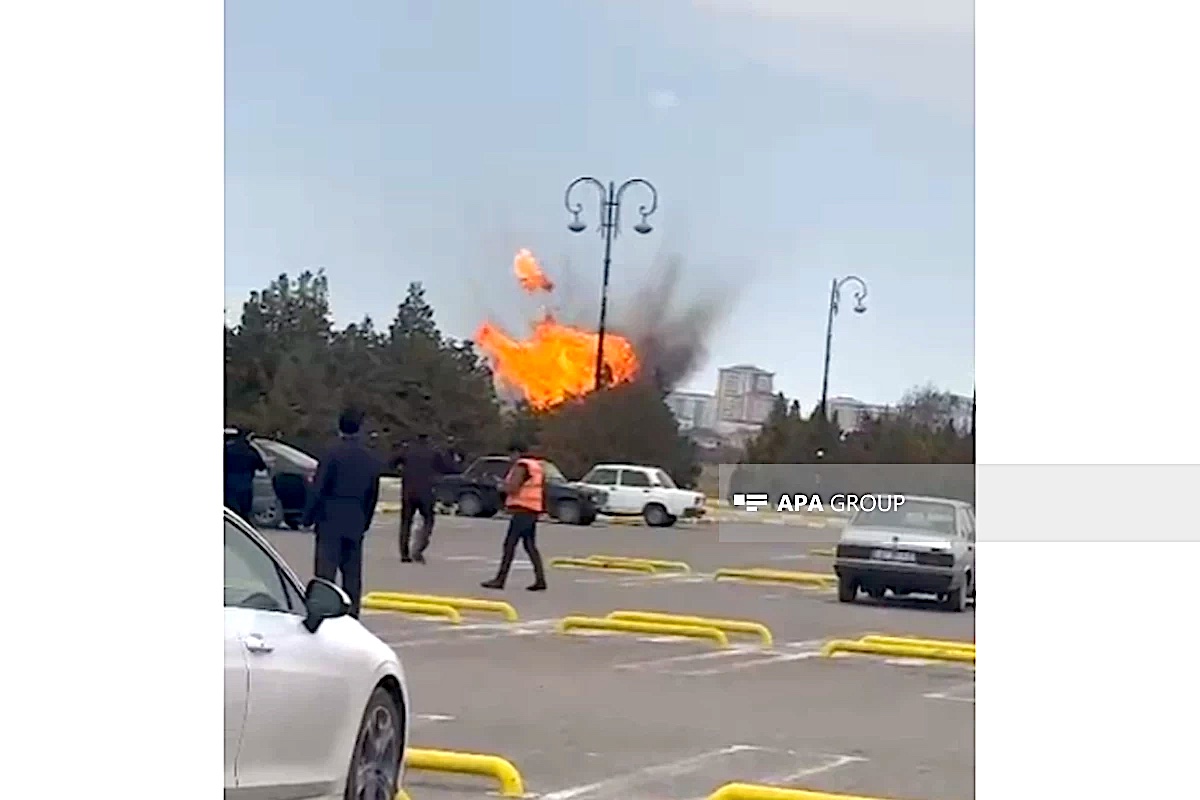

“I had a greenhouse where I planted about 3,000 seedlings. I have only harvested twice. The wind destroyed the greenhouse. I lost three thousand. The wind also destroyed three neighbor’s greenhouses. Nobody cares, nobody helps.”

Fuad Musayev, a resident of Goychay, informed Meydan TV about this. He is one of the workers whose agriculture has been severely affected by adverse weather in recent days.

Hundreds of villagers in the area like him suffered damage due to severe damage to greenhouses and orchards.

According to residents, they lost their investment, their hard work went unrewarded, and they were left without a livelihood for a whole year.

The villages of Lekchyplag, Yalman, Garaman, Garagydyr and Myrty, which have the largest number of greenhouse crops among the 30 villages of the region, were seriously affected.

In Lekchiplag, the largest village with 1,300 family farms, dozens of fruit trees, houses and outbuildings were damaged, but in general more damage was recorded in greenhouses.

Yasif Javadov, a resident of the village, is one of the victims. He also believes that the damage should be redressed:

“In April I planted 2,000 tomato seedlings and they were growing well. The wind completely blew off the roofs of my two greenhouses and uprooted my 300 seedlings, throwing their crops to the ground. I suffered a total damage of AZN 1,300 [about $765]. I spent AZN 400 to cover the greenhouse again. The fruits of more than 100 fruit trees were also scattered on the ground by the wind. Domestic birds are dead. However, no one came and recorded the damage.”

“Because losses are high, many insurance companies are applying more stringent measures”

Since 2019, agricultural insurance has been a service concluded between the Agrarian Insurance Fund to protect agricultural producers, and it has many shortcomings, says agricultural expert Ilkin Ibragimov.

“The damage is not reimbursed because the owners of small farms do not have the funds for insurance. In large farms, insurance is obligatory and paid for, because there is a subsidy.

Agricultural insurance in our country is based on the Turkish Tarsim model. Under this model, the state pays half of the non-life insurance premiums. The rest is the responsibility of the manufacturer. Agricultural insurance is noted in the world as very unprofitable. Because losses are high, many insurance companies are taking more stringent action. They also want to earn money, so they raise fees for services. On the other hand, awareness of agricultural insurance is weak, as is the creation of a personal account via the Internet, the rules for its use are currently inaccessible to most villagers. This is a serious problem from Baku to the regions. We really need government support.”