Russia sanctions: what Georgia stands to lose

Russian President Vladimir Putin’s flight ban on air links between Russia and Georgia came into effect on July 8, and Russian citizens have been urged to refrain from traveling to Georgia.

The Kremlin has not yet pulled the heavy-hitting sanctions against Georgia, but a bill to do so lies ready in wait in the State Duma – all it needs is Putin’s signature.

Sanctions are one of the main levers that Russia can use to influence Georgia.

JAMnews looks into what Georgia stands to lose if Russia decides to punish the country with sanctions.

__________________________

How much money comes in from Russia?

Money comes into Georgia from Russia in three ways: tourism, remittances (transfers from immigrants) and exports.

In 2018, in total, Georgia received about $1.6 billion through these three routes: about $700 million from Russian tourists, $457 million via remittances and $437 million in the export of Georgian products.

The dependence of the Georgian economy on Russia grows annually.

In 2012, the total amount of funds received from these three sources amounted to 6.3% of Georgia’s economy (totaling $1 billion), and in 2018, the economy’s dependence on Russian money was 10 percent.

The official reason for the introduction of the embargo was the low quality of Georgian products. But even in Moscow the decision was recognized for what it was: a political maneuver.

At that time, 80% of Georgian products were completely dependent on the Russian market. Thus, the embargo caused damage worth millions of lari to both individual business owners and the country’s economy as a whole.

The embargo was removed in 2013, after the Georgian Dream government came to power in Georgia, and Georgian products returned to Russian markets. In the first year of 2014, products headed for Russia from Georgia totaled $ 275 million (mainly wine and mineral waters), and thus Russia regained its position as the main importer of Georgian products.

Tourism

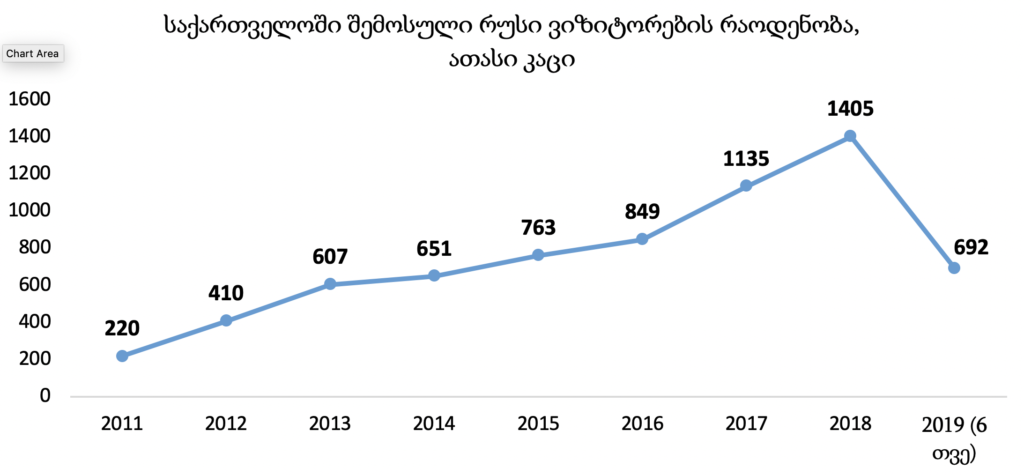

Dependence on Russia in recent years has increased the most in terms of tourism.

In 2012, only 410,000 Russian tourists came to Georgia, but in 2018, numbers were up to 1.4 million.

According to the National Tourism Administration of Georgia, one tourist from Russia spends in Georgia, on average, about $520.

Considering the fact that 30% of tourists come to Georgia by plane, Putin’s decision to ban flights will deprive Georgia of $100-150 million by the end of the year.

It is logical to assume that the recommendation of the Russian president to Russian citizens to refrain from traveling to Georgia will probably have an impact on those tourists who come to the country by car as well. Thus, it is impossible to predict exactly how much the number of tourists will decrease.

Remittances

Remittances from Russia peaked in 2013 to $801 million. The following years were years of crisis for the Russian economy and the volume of transfers decreased significantly: in 2018, only $457 million was received.

The year 2019 also began with a decrease in the volume of transfers – the figure for January-May is 6% lower than the same indicator for the last year.

Technically, it is very difficult to impose sanctions on money transfers: at the end of 2006, Russia carried out a mass deportation of Georgians and imposed economic sanctions, but the volume of remittances still increased. In the first year of the sanctions in 2007, transfers were 48% more than in 2006.

Modern technologies provide many opportunities to transfer money from one country to another, for example, using cryptocurrency. But alternative means increase the cost of the transfer.

The volume of remittances from Russia depends mainly on the economic situation in Russia.

And taking into account that the majority of Georgians in Russia either have Russian citizenship or are located legally in the country, even if sanctions are applied, a sharp reduction in the volume of transfers is unlikely.

Exports

In 2018, 29% of exports to Russia – worth $437 million – were accounts for by ferroalloys.

Next comes wine. Last year, $115 million worth of Georgian wine was exported to Russia, which is 26 per cent of total exports. 50 million USD in mineral and plain waters were also exported to Russia, in addition to $21 million dollars in other alcoholic beverages.

In 2018, alcohol and mineral waters worth $186 million were exported from Georgia to the Russian market. As of the first five months of 2019, $89 million in beverages has been exported from Georgia – thus, even with the toughest sanctions against alcohol and mineral water, in 2019 the loss will be below $100 million.

Conclusion

To sum up, should multilateral sanctions against Georgia be introduced, losses will largely be borne by tourism and exports, and losses could entail between $200-500 million dollars – the latter being the worst scenario, in which Russians stop coming to Georgia even by land vehicle.

Forecasts for longer periods are difficult to assess.

The sanctions will be most painful for the tourism business (hotels, cafes and bars), people working in the field of viticulture and winemaking and in the mineral water business.

What is the solution?

When sanctions are imposed unexpectedly and the country is not ready for them, the negative economic consequences are irreversible and it is impossible to avoid them in the short term.

For Georgia, Russian sanctions will not come as a surprise – the country went through the experience before in 2006.

Today, 13 years later, Georgia may face the same problem and is again unprepared.

First of all, it is necessary to take all measures to reduce Georgia’s economic dependence on Russia. It does not matter whether Russia will impose sanctions on Georgia at this stage and will restore flights. The problem will remain on the agenda.

Based on the tense political relations between the two countries, Russia will never be a stable market for Georgian business.

Russian sanctions can be dangled over Georgia’s head at any time.

The more successful Georgia will be in the future and the closer it will become closer to the EU and NATO, the more annoyed Russia will be, which traditionally uses economic sanctions to punish Georgia.

Accordingly, the strategic task of Georgia in any case should be access to new markets and the maximum reduction of dependence on Russia.

This does not mean that exports to the Russian market should be artificially restricted, or that Russian tourists should not be allowed into Georgia.

Reducing dependence on Russia means that the country must achieve a pace of development so that Georgia’s economy grows faster than revenues from Russia.

That is what will reduce the dependence. However, in recent years, the Georgian Dream has spent quite large financial and political resources to restore access to the Russian market.

For example, in 2013-2018, the government allocated 13 million lari to advertise Georgia for Russian tourists.

All these years, the government has not warned Georgian businesses that the Russian market is not reliable. On the contrary, it was proud of the return of the Russian market and argued that politics and economics should be separated.

If sanctions are imposed, Georgia will experience economic growth failure, and will have to find new markets for its products and guide the tourism industry in new directions.

The government of Georgia needs active and proper communication with the United States and the European Union in order to receive help to reduce the negative impact.

In turn, the government should provide benefits to the affected sectors (despite the fact that those who trusted the Russian market had to take risks into account) with tax, credit or other government programs.