Erdogan's government about to face a trial by lira

The depreciation of the Turkish lira, unprecedented in the past twenty years, has seriously affected the credibility of President Erdogan‘s government and has provided citizens with an incentive for a protest.

On November 23, the US dollar rate in Turkey increased by 18% in one day and amounted to 13 lira, breaking a new record. Thus, the Turkish lira has experienced its worst day since the transition to a floating regime during the 2001 economic crisis.

- Op-ed: Turkey is searching for an ‘external enemy’

- Turkey: inflation is out of control. Might this help the opposition?

- How has the fall of the Turkish lira affected the countries of the South Caucasus?

Protests

As a result of the rampant fall in the exchange rate of the lira against major world currencies and the rise in prices, a wave of protests swept Turkey. In the Turkish segment of social media, the number of messages with a hashtag urging the government to resign has reached 150,000. On November 23 and 24, in the capital Ankara, as well as in Istanbul and Izmir, protesters took to the streets with the slogan “AKP [ruling party in Turkey – JAMnews] must report to the people” and demanding the resignation of the government. In all cities where the rallies took place, the police violently dispersed the protests, dozens of citizens were detained.

Left-wing parties took an active part in the protests.

“During the AKP rule, Turkey has experienced the poorest, most unemployed and hungry times in its history. The only ones who benefit from this economic picture are AKP and its leadership. They rob Turkey as they please, which has been turned into a paradise of cheap labor. They violate the rights of workers, every day they report a rise in prices, and then they want millions of workers to be satisfied with their lives”, the statement of the Turkish Workers’ Party said during a protest in front of the country’s central bank.

The Turkish Workers’ Party has called for a general strike demanding the “palace regime” to resign immediately.

“War of Liberation”

On November 23, during his speech at a cabinet meeting, Turkish President Recep Tayyip Erdogan once again assessed the economic crisis in which the country found itself as a result of the ‘games’ of outside forces. According to him, the daily rise in prices, the depreciation of the lira are all the results of sabotage.

“We are observing them playing with exchange rates and interest rates, trying to destabilise the country. We observed the same games during the fight against terrorist organizations, launched a counterattack and won. There were similar games during the coup attempt, together with the people they resisted and won. We emerged victorious from each struggle, having stood together with the people. We will lead our nation out of this war of liberation as a winner”, Erdogan said.

The leader of Turkey’s main opposition party, the Republican People’s Party (CHP), Kemal Kilicdaroglu, reacted to the president’s speech in the following way: “Okay, but what happened that made it necessary to start a war of liberation? Did someone else rule the country?”

“The kitchens are on fire. The authorities blame wholesalers, shop owners. I met with them, wholesalers say that “the starting price is very high, farmers do not get any support, all the support goes to the owners of the land, not to those who cultivate it. Out of 55 million tons of products, 29 million do not get approved and registered. The box is more expensive than the tomatoes kept in it. Fuel, road, and transport prices affect the cost price. We work with a mark-up of only eight percent, we do not raise the price.

The stores began to hire employees who change price tags hourly. Turkey has come to a point where those selling goods incur losses. If we do not support the producers, we may face the problem of hunger. Agricultural products account for 77% of the products sold. Prices will not go down under control, under pressure, will go to the black market. With each rise in the dollar, prices rise. And who melts the lyre? They are trying to transfer responsibility to citizens”, Kilicdaroglu said.

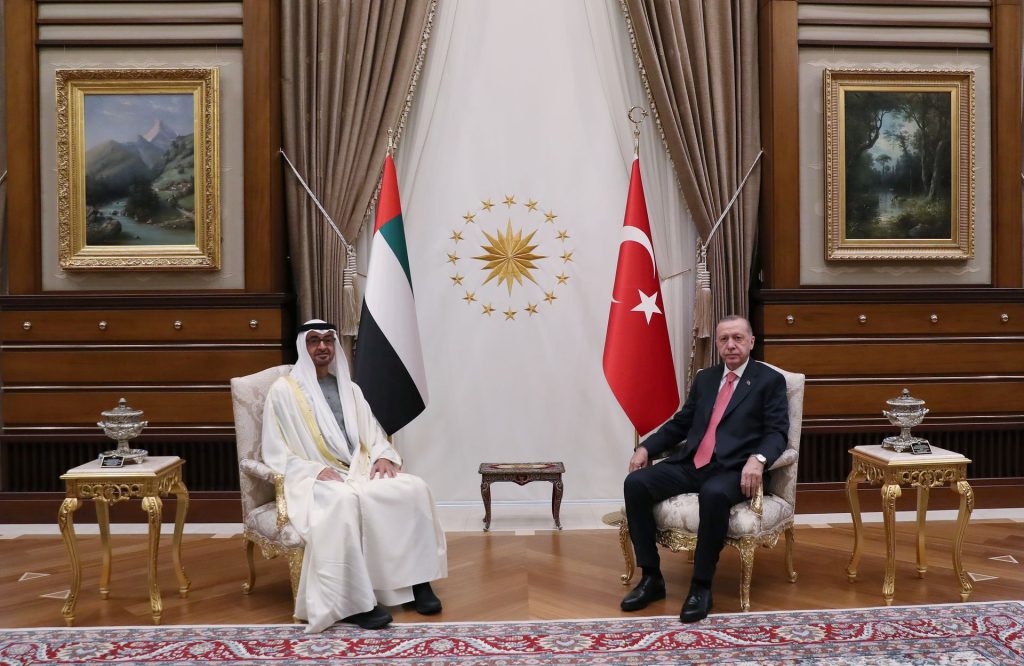

10 billion dollars from the Arabs

On November 24, Turkish President Recep Tayyip Erdogan received Prince of Abu Dhabi Sheikh Mohammed ibn Zayed al-Nahyan, who is on an official visit to the country. They signed a direct investment agreement between the UAE and Turkey. The document covers areas such as energy, petrochemistry, technology, transport, infrastructure, healthcare, financial services, food and agriculture.

After the meeting, the head of the board of the Abu Dhabi Development Holding, Mohammed Hasan al-Suwaidi, said that the United Arab Emirates had allocated $ 10 billion to invest in the Turkish economy.

For many years, Turkey and the UAE, whose relations were not particularly friendly due to regional differences, were negotiating to strengthen economic ties and reduce tensions. This is the first large-scale economic agreement signed between the two countries since the beginning of negotiations.

But this news was met ambiguously on social media. One of the users wrote the following: “He did not deny us one percentage point [meaning the change in the central bank’s discount rate – JAMnews], but forced us to ask the Arabs for help. My beautiful country is being sold piece by piece”.

Another social media user commented on the message about the signed agreement on Twitter of the Rûdaw media group:

“To ask for help from the Arabs who were laughed at … I hope now they understand that there is no need to laugh at anyone”.

Intervention without interference

According to economists, the reason for what is happening is President Erdogan’s attitude towards the situation. Following the model that the president pointed to in his last speech at a cabinet meeting, preventing currency appreciation is not the ultimate goal. Along with the high exchange rate, an increase in exports is expected, but the growth of inflation is forgotten. Therefore, economists are confident that it is now difficult to predict to what numbers the rate of major foreign currencies will rise. The new system carries risks.

Burak Arzova, professor at the Faculty of Management of the University of Marmara, speaking about the growth of foreign exchange rates, said: “There is no end to this, it is like a bottomless well”.

“People began to buy up dollars in a panic after it became clear that the government would continue to lower the interest rate and did not intend to stop the growth of the rate. Because if you cannot and do not intend to stop the growth of the rate, then you will not know how long it will grow for”, the professor emphasized. According to Arzova, who expects big shocks due to rising inflation, foreign investors will avoid assets in the Turkish lira due to the rise in exchange rates. He predicts that the government expects that in spring, with an increase in the tourist flow, and, accordingly, the arrival of foreign currency the loss of the lira will be compensated, which will also be facilitated by an increase in exports and a reduction in the current deficit. But at the same time, there is a possibility that foreign exchange rates will grow to unexpectedly high levels”, the economist summed up.