Georgian PM: Tbilisi won’t walk away from UAE-backed Eagle Hills investment project

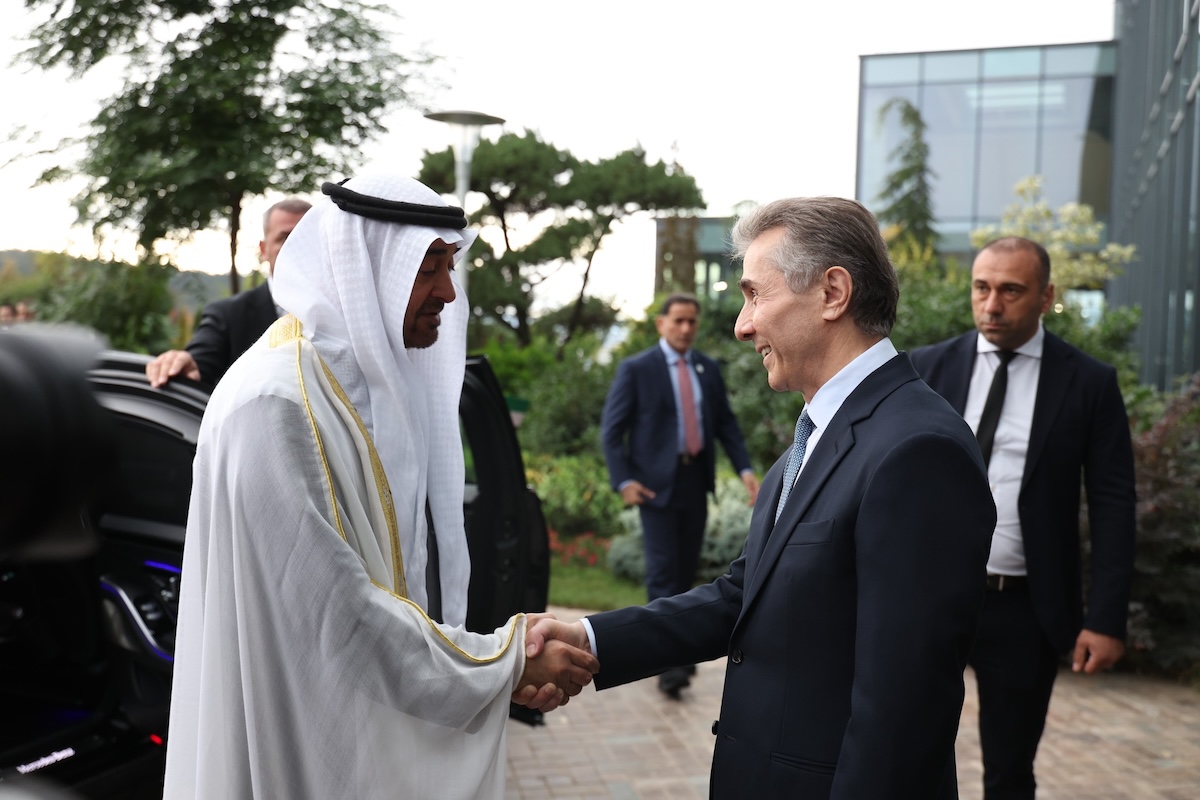

Irakli Kobakhidze on Eagle Hills

“We truly cannot afford to walk away from any investment project — especially one that is absolutely flawless,” said Georgian Dream Prime Minister Irakli Kobakhidze during a parliamentary plenary session, where he was asked about the Eagle Hills project.

An investor from UAE is set to build a new city near Tbilisi and Gonio — a project and contract that have become the subject of intense debate in Georgia. The agreement signed with the investor has been classified as a commercial secret by order of the government.

The state has taken a 33% stake in Eagle Hills’ subsidiary and formally joined the project, contributing 260 hectares of land in Gonio on the Black Sea coast and 590 hectares of forest parkland near Tbilisi, where large multi-purpose complexes are planned. According to the press release, the total value of the projects amounts to 6.6 billion dollars.

According to him, Georgia should not only move ahead with the Eagle Hills project but also focus on attracting more initiatives of this kind.

What Kobakhidze said

“Over the past four years, our nominal economy has doubled in dollar terms and continues to grow. We have the fastest growth rate in Europe — an average of 9.7% since 2021. This year we are close to 8% growth, although, of course, that is still not enough. One of our key priorities must be to maintain this pace. The level of our economic development remains quite low. For the first time in our history, GDP per capita will exceed 10,000 US dollars this year, yet we are still behind every EU member state, even the poorest ones — by roughly 30–40%.

According to last year’s data, the poverty rate still stood at 9.4%. This means that 350,000 of our citizens continue to live in poverty. In these circumstances, the government — and any responsible citizen — should be committed to economic development and to sustaining growth.

In such conditions, we truly cannot afford the luxury of rejecting any form of support or any investment project, especially one that is completely flawless and without shortcomings.

We should not only avoid rejecting such initiatives but should, from the outset, focus on bringing even more projects of this kind into the country. When opponents of this project see that 350,000 people still live below the poverty line, when they see how far we still have to go to catch up with developed economies, and yet they still speculate on such issues, it hardly speaks to their integrity,” Kobakhidze said.

According to the prime minister, claims about the project’s profitability show that opponents “struggle with both electoral and investment mathematics.”

“We informed the public that the state’s dividends from this project will total around two billion lari. Since our share is one-third and Eagle Hills holds two-thirds, Eagle Hills’ dividends will amount to about four billion lari — roughly 1.5 billion US dollars.

Eagle Hills is investing a total of 6.6 billion US dollars in this project and expects a net profit of 1.5 billion. The return on investment is around 23%. You can look it up: for similar development projects, an optimal return is considered to be up to 25%. A return of up to 25% is regarded as good profit for such investors. In this case, Eagle Hills’ profit is close to the upper limit — 23%.

Yet critics accuse Eagle Hills — a company with extensive experience — of miscalculating its own numbers, claiming the profit is too small, even though they can easily check whether 23% is ‘little’ or ‘much’. This is a return close to the optimal threshold.

Here too, they speculate and openly lie. Such arguments are improper, especially after we provided detailed explanations regarding profitability. They begin with a lie and then build illogical conclusions on top of it.

They claim the company will withdraw all 1.5 billion dollars in ten years. No one has said this. On the contrary, we explained that both the state (through dividends) and Eagle Hills will withdraw returns gradually, as is normal.

So they deceive themselves by insisting that the profit will be taken out after ten years, that inflation will erode it, and therefore the real return will be far below 23%. They lie to themselves and then conclude that Eagle Hills’ profit will be insufficient.

In reality, as with any development project, investments will be withdrawn gradually, while profit will accrue as the project progresses. The company’s net profit will amount to 23%, which is close to the optimal upper level of 25%. People with a questionable political past trying to teach Mohammed Alabbar and Eagle Hills how to make a profit — that is laughable,” Kobakhidze added.

Kobakhidze also said the state had secured the maximum possible benefit from the project.

“I can assure you that we have extracted the maximum achievable dividends or any other profit. Everything else we hear is, unfortunately, speculation. In this regard, I would like to recall what the founder of Eagle Hills told us when we discussed these issues.

A similar campaign was organised in Serbia by political opponents of an Emaar project. It ended with those very opponents buying apartments in the development implemented by Emaar. I would like to wish all opponents of this project the same — to buy apartments here, and they will be able to do so at market prices,” Kobakhidze said.

According to the prime minister, the government’s expectations differ from those of the Eagle Hills founder, who expects to sell around 60% of apartments to foreign buyers.

“In both areas, around 16,000 apartments will be built. Mr Alabbar, the founder of Eagle Hills, said he expects to sell roughly 60% to foreign clients. This projection is based on the company’s experience and on the fact that it has a well-established global marketing network. He presented this as an additional economic benefit: the more foreign buyers, the more capital flows into the economy from abroad. Our expectations, however, are slightly different.

Current statistics in Georgia show that roughly 80% of apartments in new developments are purchased by Georgian citizens, and 20% by foreigners. We believe that this project will follow a similar pattern — close to 80%. This is our logical assessment.

Opponents are speculating again, claiming that apartment prices will be extremely high and that Georgians will be unable to afford them, repeatedly citing the same numbers. This suggests a coordinated campaign.

They claim that apartments in Gonia and Krtsanisi will cost 12,000 dollars per square metre — a figure with no basis. Representatives of various parties are repeating the same claim in unison.

Let me remind you again: mathematics is not the strongest side of these people. They are not particularly strong in the humanities either, but it seems their gaps in mathematics are even greater.

Sixteen thousand apartments, assuming an average size of 100 square metres, amount to 1.6 million square metres of commercial space. If the company sold all of this at 12,000 dollars per square metre, its revenue from apartments alone would be 19.2 billion dollars — an enormous profit. In that scenario, the state would not be receiving two billion lari but about four billion dollars.

You can judge for yourselves how detached from reality our opponents are — from Lelo to Alt-Info to the United National Movement — when it comes to mathematics. Apartment prices will be significantly lower. I do not want to name specific figures so as not to interfere with Eagle Hills’ commercial decisions, but it is clear that prices will be several times lower than those cited by critics.

This is why we expect the share of Georgian buyers in this project to be similar to other standard developments. I think the figure will be close to 80%. Let’s wait for the sales statistics,” the prime minister said.

Irakli Kobakhidze also outlined the direct and indirect benefits Georgia will gain from the Eagle Hills project.

“First, let me remind you that around 16,000 apartments will be built, covering approximately 1.6 million square metres. The residential space alone will include about 7,000 apartments and houses in Tbilisi and 9,000 in Gonio. Hotels with more than 1,400 rooms will also be constructed, with investments of around 700 million dollars in this sector. One can imagine the impact such major investments will have on tourism, particularly the hotel industry.

The overall effect on Georgia’s economy is estimated at around 11 billion lari, which is a very significant figure. I would like to remind you that, for the first time in history, our gross domestic product will exceed 100 billion lari this year. Imagine that a single investment project could bring in roughly 10% of that. This represents an enormous economic benefit for the state,” Kobakhidze added.

Irakli Kobakhidze on Eagle Hills