Foreign direct investment and trade and economic relations between Georgia and Uzbekistan

economic relations between Georgia and Uzbekistan

Georgia recorded the highest growth in the number of projects relative to GDP, from eight in 2021 to 32 in 2022, while its GDP increased from $19 billion to $25 billion. Foreign direct investment reached $2 billion. The number of foreign investors has doubled.

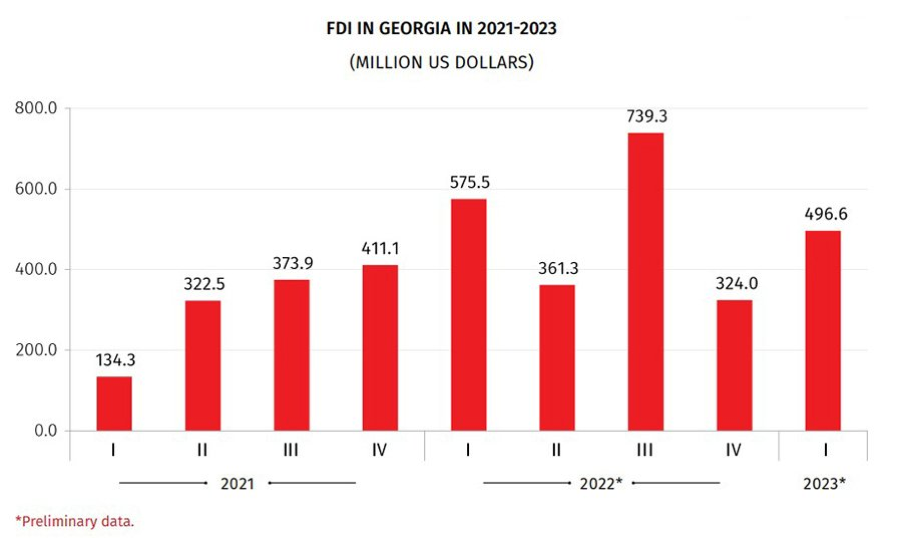

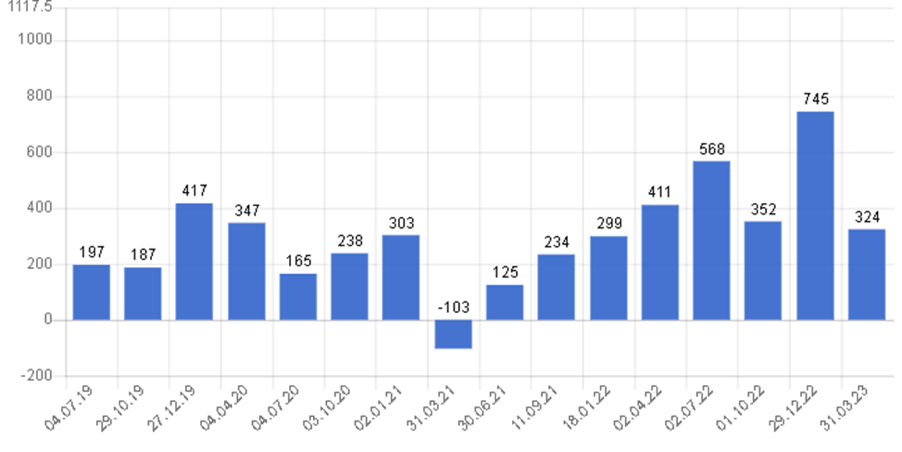

According to preliminary data from the National Statistical Office of Georgia, foreign direct investment in the 1st quarter of 2023 amounted to $496.6 million. This is 13.7% less than the preliminary data for the 1st quarter of 2022 and 53.3% more than the parameters for the 4th quarter of 2022.

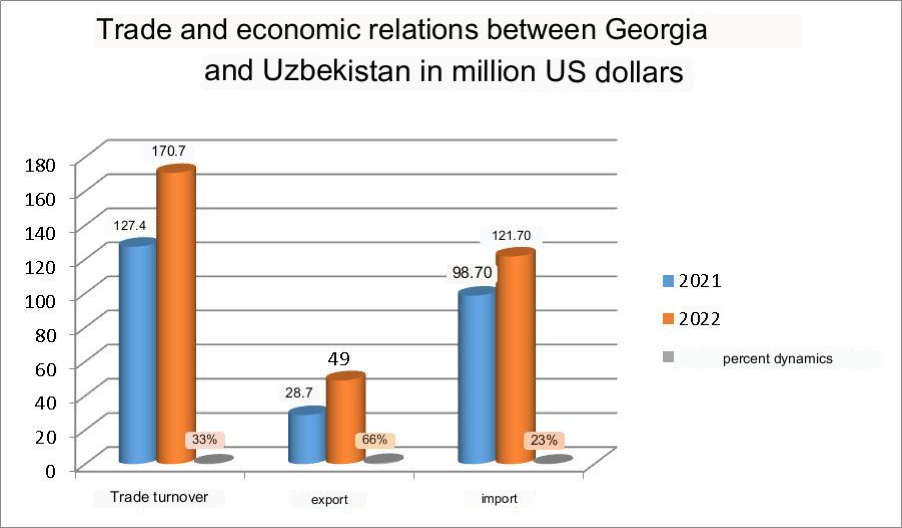

As for trade and economic relations with Uzbekistan, over the past 6 years, foreign trade between the two countries has almost doubled. Last year alone, trade between Uzbekistan and Georgia increased by more than 30%.

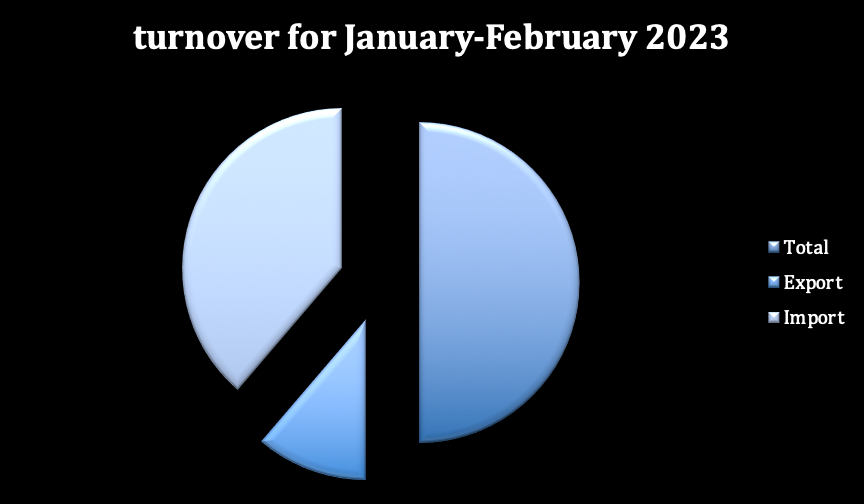

Volume in millions of US dollars

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Trade turnover | 87.8 | 88.9 | 58.3 | 112.0 | 94.7 | 127.4 | 170.7 |

| Export | 62.6 | 62.5 | 9.9 | 18.3 | 20.7 | 28.7 | 49 |

| Import | 25.2 | 26.4 | 48.4 | 93.7 | 74.0 | 98.7 | 121.7 |

The parties agreed to jointly increase the trade turnover to $500 million in the coming years. To achieve this goal, it was proposed to develop and approve within two weeks a Plan of practical measures to further deepen trade and economic cooperation for 2023-2024, with the inclusion of measures to organize mutual trade missions, as well as exhibitions of the industrial potential of the two countries.

Particular emphasis is placed on the development of ties with the involvement of absolutely all regions of Georgia and Uzbekistan in joint projects and initiatives. In this regard, it was proposed to establish at the first stage bilateral partnerships between Samarkand and Batumi, as well as Bukhara and Mtskheta.

At the end of 2022, the trade turnover amounted to $170.7 million (+32.9%), including exports – $49 million (+65.9%) and imports – $121.7 million ( +23.1%.

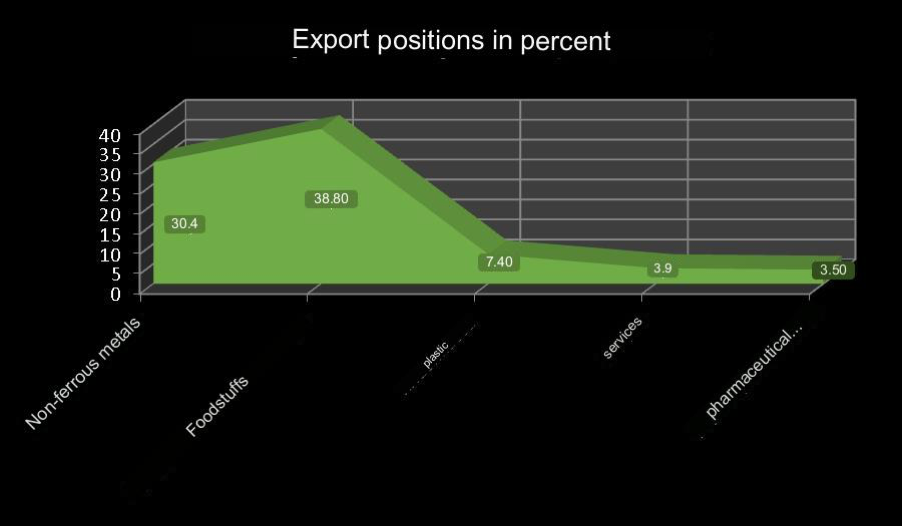

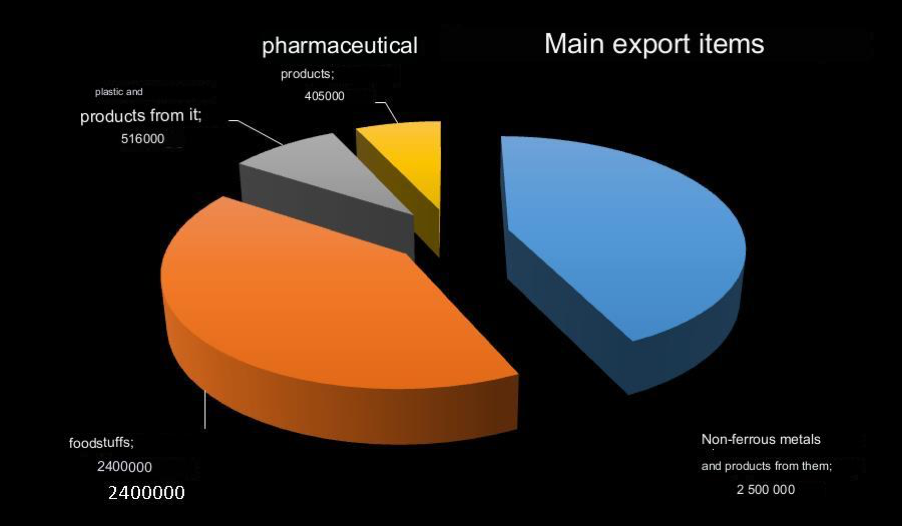

Main export items: non-ferrous metals and products from it (30.4%), food products (38.8%), plastics and products from it (7.4%), services (3.9%), pharmaceutical products (3 .5%) and others.

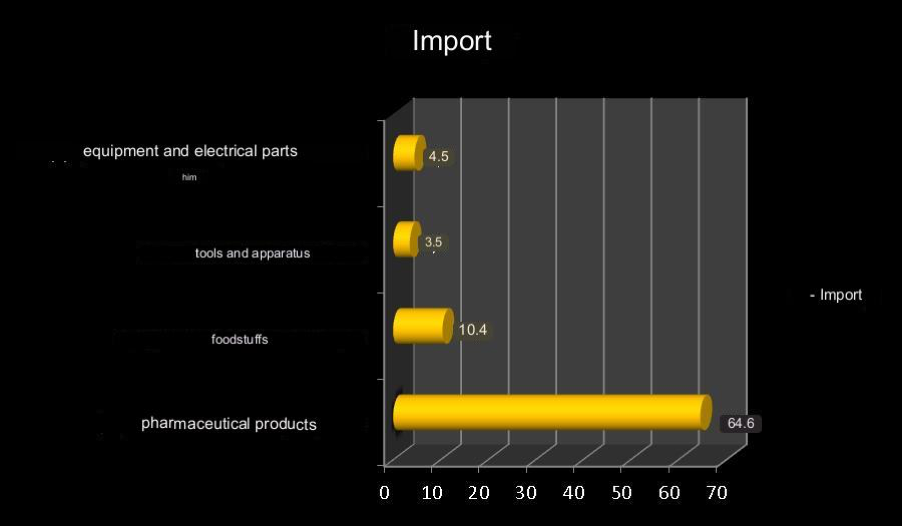

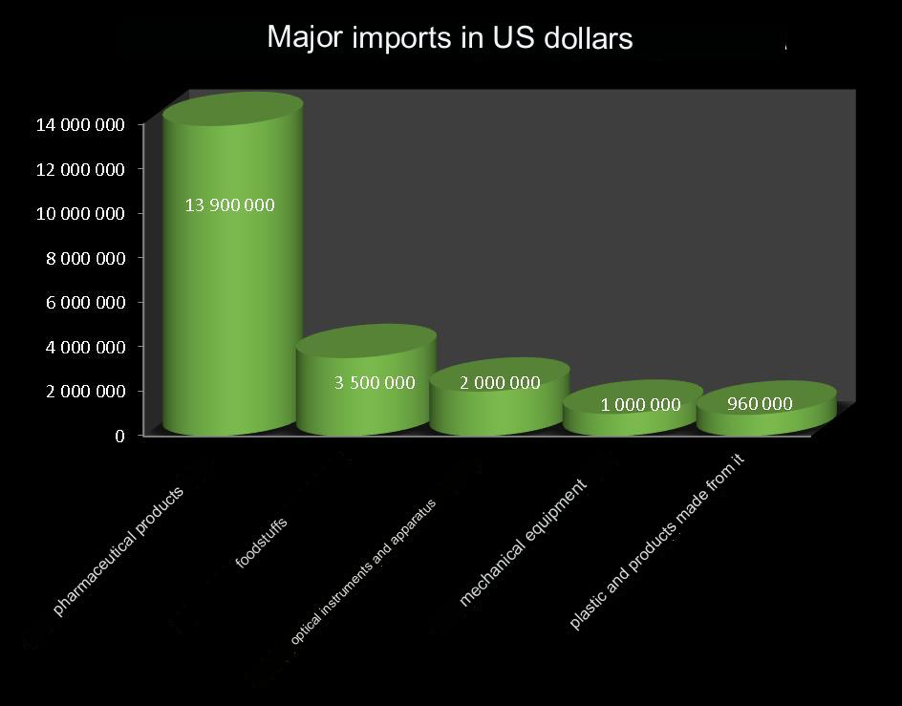

Imports: pharmaceutical products (64.6%), food products (10.4%), optical instruments and apparatus (10.3%), electrical equipment and parts for them (4.5%), services (4.1% ) and etc.

In January-February 2023, the trade turnover amounted to

29.3 million dollars (+13.1%), including export – 6.6 million dollars (+42.7%), import – 22.7 million dollars (+6.7% ).

Main export items: Non-ferrous metals and products from them (2.5 million dollars), food products (2.4 million dollars), plastics and products from it (516 thousand dollars), pharmaceutical products (405 thousand . dollars).

Main Imports: Pharmaceuticals

($13.9 million), food products ($3.5 million), optical instruments and apparatus ($2 million), mechanical equipment ($1 million), plastics and plastic products ( 960 thousand dollars)

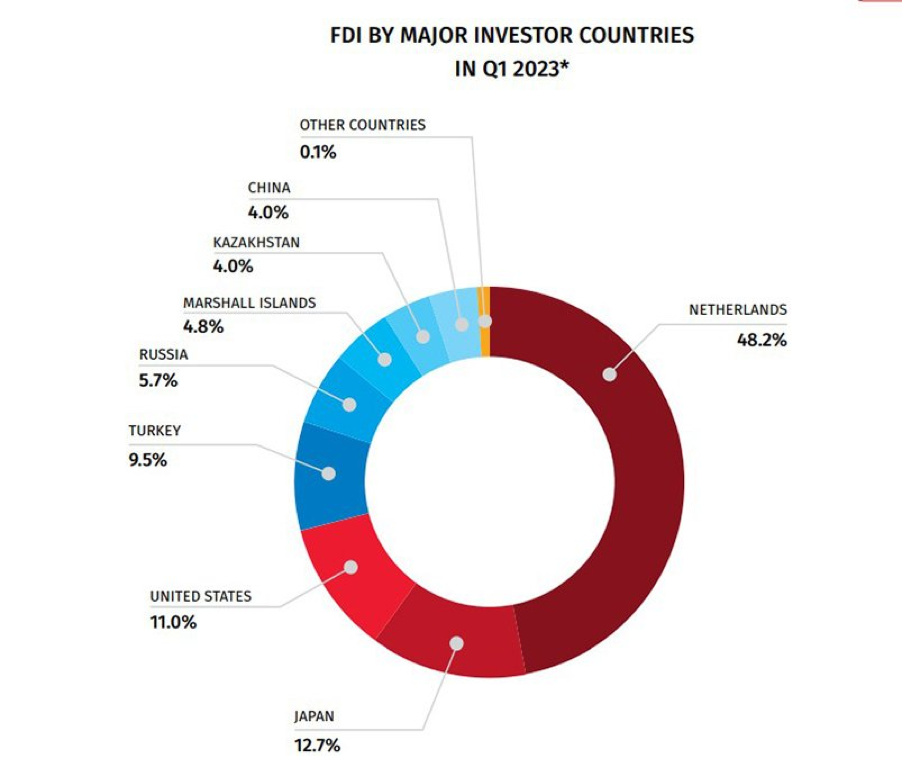

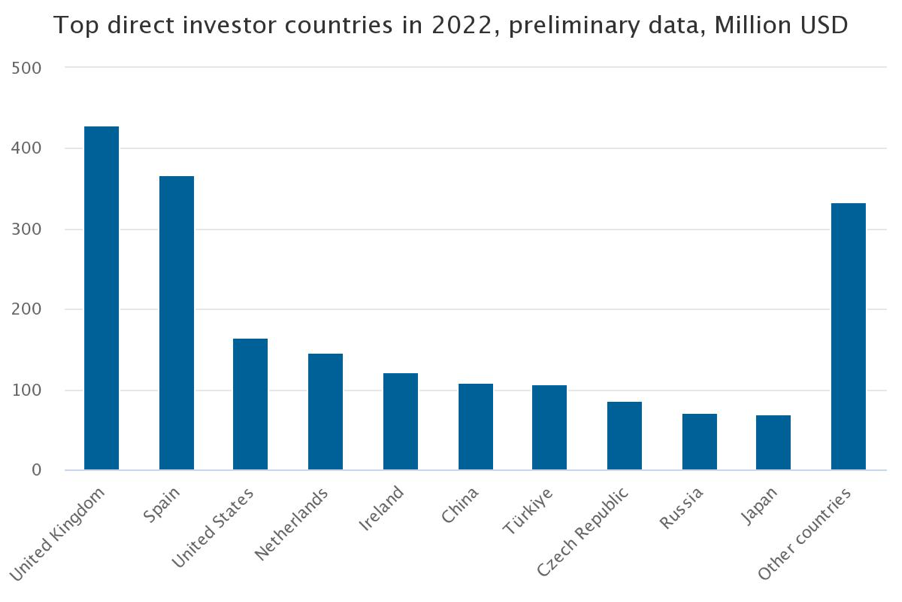

Leading investment countries

Georgia’s equity capital increased by 17% compared to the preliminary data for the 1st quarter of 2022 and reached USD 300.2 million, i.e. 60.5% of total FDI. Reinvestments amounted to 189.6 million or 38.2%. In 2021, the largest amount of funds was invested from the Netherlands – $138.3 million. Turkey was in second place with $100 million, Russia was third with $75.5 million. In 2022, the United States was in the lead with $163.9 million, followed by the Netherlands with $145.7 million and China with $108.5 million. Turkey was a little behind. – 106.5 million. Russia invested 71 million, Japan – 68.7 million, Marshall Islands – 40.5 million. Geostat also singled out Switzerland and Denmark among investors.

In the first quarter of 2023, the Netherlands came out on top in terms of investment with $239.6 million, more than in the entire previous year. The second place was taken by Japan – 63.2 million, the third by the USA – 54.7. Representatives of Turkey invested $47 million in Georgia, and $28.2 million in Russia.

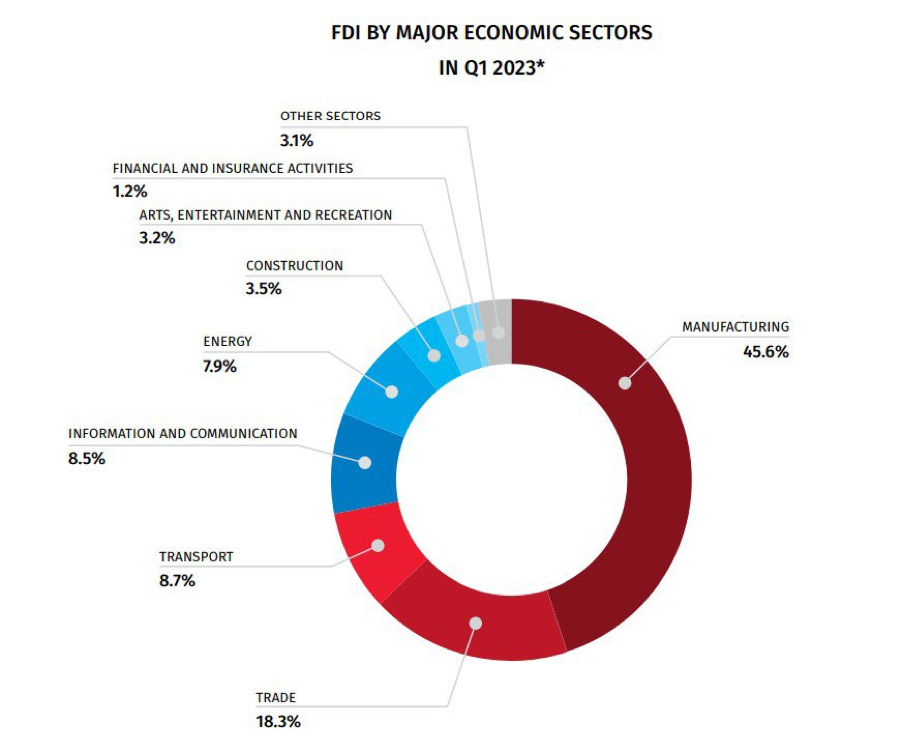

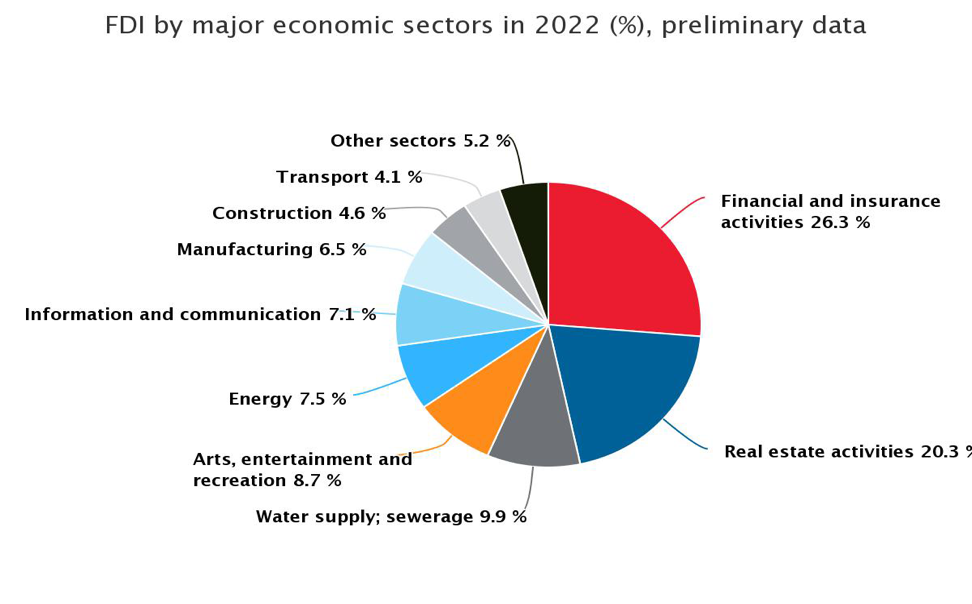

Investment sectors

In terms of investment sectors in 2021 and 2022, financial and insurance activities were in the lead – 471 million and 526 million, respectively. Art, entertainment and recreation are in second place – 232 million and 173 million. Energy is in third place, 185 million and 149 million. In the first quarter of 2023, the largest amount of foreign direct investment was directed to production – more than 226 million. A significant amount was invested in trade – about 91 million. More than 43 million FDI was recorded in the transport sector, 17.5 million in the construction industry (91 million for the entire 2022).

Global investment in Georgia in US$ million (data includes Q1 2023)

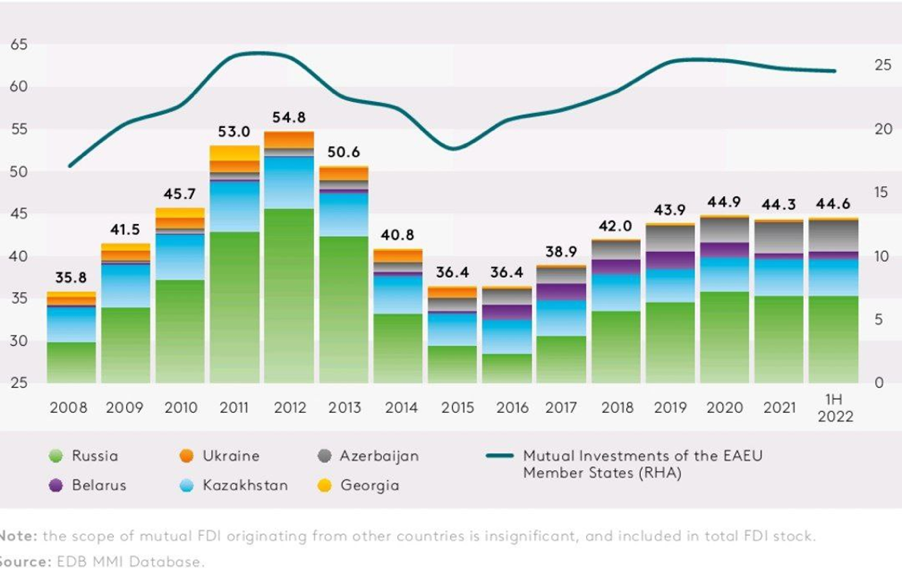

Changes in Mutual FDI Stock of the CIS Countries, USD billions

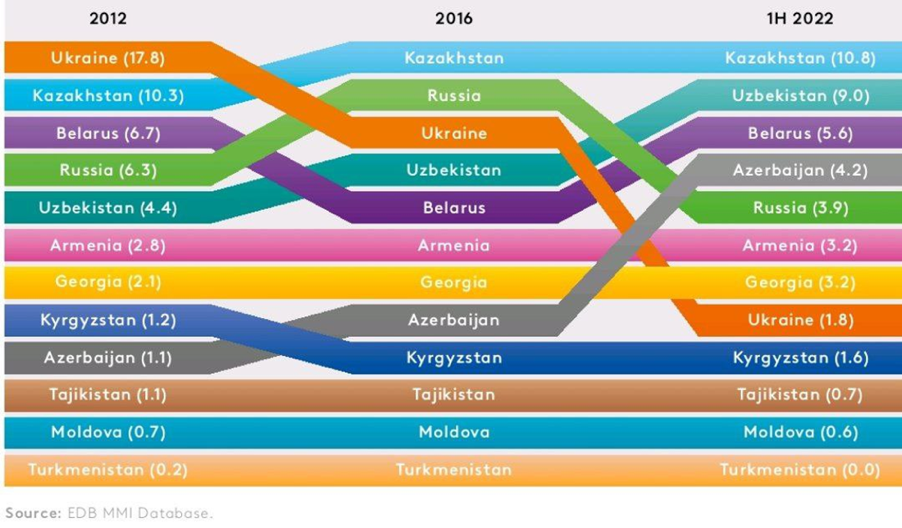

By the end of the first half of 2022, its share in total inward mutual FDI was 24.3%. It is followed by Uzbekistan (20.1%) and Belarus (12.6%). Russia is in fifth position (8.8%), trailing Azerbaijan (9.5%). Significant figures are also reported for Georgia (7.2%) and Armenia (7.1%).

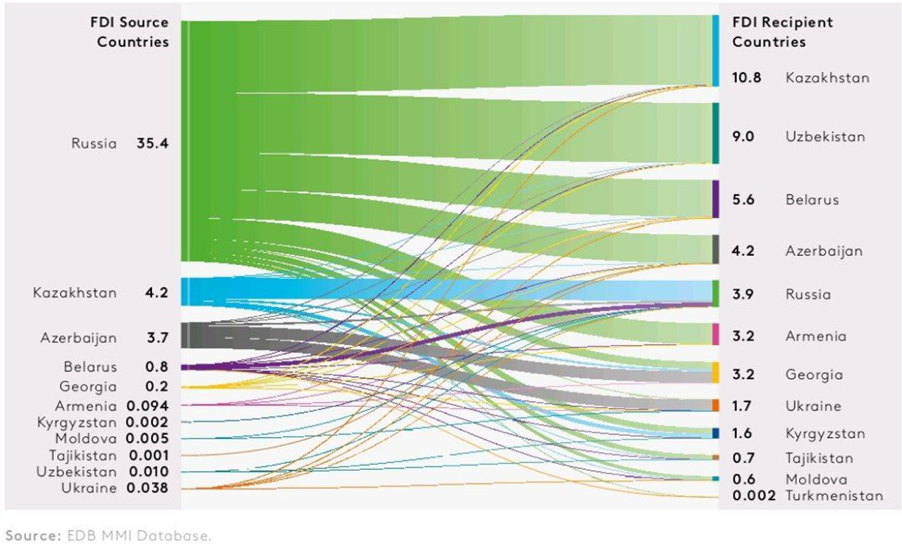

The EDB MMI database contains 58 records of country-to-country investment flows among the 12 post-Soviet countries. The sixth-largest FDI direction also involves Russia, but it is Kazakhstan’s FDI in Russia. Significant investment directions that do not involve Russia are Azerbaijan’s FDI in Georgia.

Mutual FDI of the CIS Countries in the Middle of 2022, USD billions

Mutual FDI: Export and Import Geography Features

According to UNCTAD (2022), Russia, Kazakhstan, and Azerbaijan are the key FDI Source Countries to third countries in the post-Soviet area. At the end of 2021, outward FDI stock originating from Russia, Azerbaijan, and Kazakhstan amounted to USD 399.3 billion, USD 26.7 billion, and USD 15.7 billion, respectively. Estimated outward FDI stock originating from other countries was as follows: Georgia — USD 3.1 billion; Belarus – USD 1.4 billion; Kyrgyzstan – USD 610 million; Armenia – USD 519 million; Moldova – USD 322 million; Tajikistan – USD 271 million and Uzbekistan — USD 198 million.

According to UNCTAD statistics, Ukraine’s FDI was driven into negative territory by massive selloffs. At the same time, the countries listed above strongly differ in terms of the role played by the post-Soviet countries as FDI recipients. For example, Kazakhstan is ahead of Azerbaijan, while Georgia is behind Belarus.

At the end of the first half of 2022, Kazakhstan was ranked first with 24.3%, followed by Uzbekistan with 20.1%, and Belarus with 12.6%. Russia was only fifth (8.8%), trailing Azerbaijan (9.5%). Significant figures were also reported for Georgia (7.2%), Armenia (7.1%), and Ukraine (4.0%). In terms of the number of projects and the amount of FDI stock, inward FDI performs better than outward FDI in some other countries as well, including Kyrgyzstan (3.5%), Tajikistan (1.5%), Moldova (1.4%), and even Turkmenistan , which posted a higher-than-zero value due to the continued implementation of three projects with FDI stock in excess of USD 1 million each.

Changes in the Rankings of Recipients of Mutual Investments in the CIS, and in the Amount of Raised Investments, USD billions

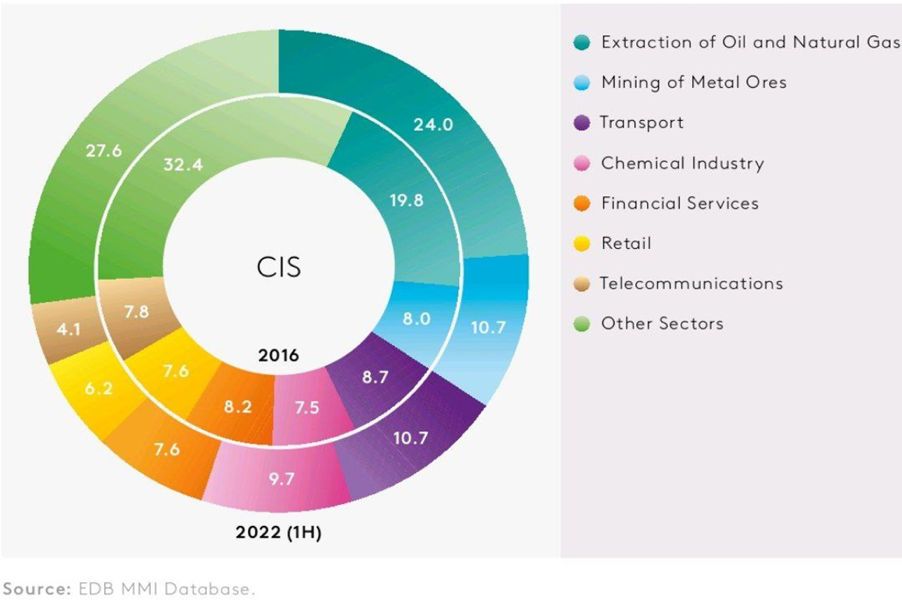

Changes in the FDI Sectoral Structure

Mutual FDI in Manufacture of Motor Vehicles, Machines and Electrical Equipment (Codes 27–29) is growing at a steady pace. Over the last six years, investments in that sector have increased by a factor of 2.2, reaching 0.5 billion in the middle of 2022. The largest investments are projects of Belarusian company Amkodor in Russia and Uzbekistan, Russia’s projects in Kazakhstan (KAMAZ) and Uzbekistan (Rostselmash), and Georgia’s and Azerbaijan’s projects in Kazakhstan.

Investments of the Non-EAEU CIS Countries and what Georgia invests in Uzbekistan

The top FDI recipients are Uzbekistan, Azerbaijan, and Georgia. In most cases, however, investors in those countries come from the EAEU member states. The only exception is the investment interaction among the neighboring Caucasian republics. Still, the largest project in Georgia (the Borjomi mineral water production plant) is being carried out by Russia rather than Azerbaijan. Another noteworthy example is Kazakhstan’s investments in the Batumi Oil Terminal (Kaztransoil, USD 285 million). Incidentally, although in Uzbekistan investors from Georgia rank only third after investors from Russia and Kazakhstan, their shares are disparate — 0.5% versus 98.2% and 0.95%, respectively. Still, we also highlight a 51% banking subsidiary with equity already as high as USD 45 million, which was opened in Tashkent in 2020 by Georgia’s TBC Bank. The latter also operates in Azerbaijan (since 2008, but with much lower FDI).

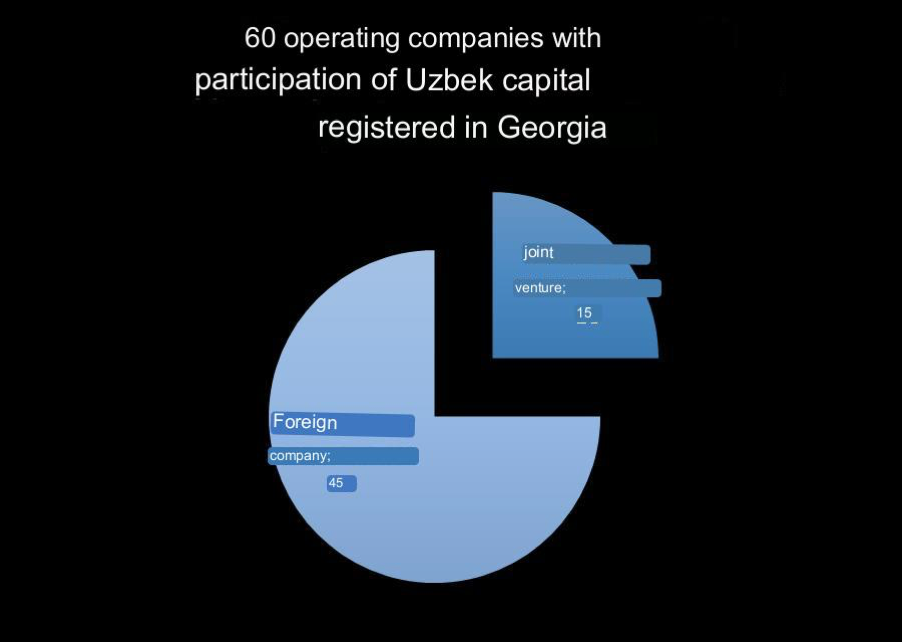

If we talk about what Uzbekistan invests in Georgia, then according to statistics , currently 60 operating companies with the participation of Uzbek capital (15 joint ventures and 45 individual entrepreneurs) are registered in Georgia.

As of March 1, 2023, 61 enterprises with the participation of Georgian capital (30 joint ventures and 31 individual entrepreneurs) are successfully operating in the Republic of Uzbekistan.

The main field of activity: trade, provision of services, transport and logistics, production of food products and building materials.

According to the data provided to us by the port of Poti

Volumes of imports from Uzbekistan – before the war in Ukraine, annual imports to Uzbekistan through Poti averaged less than 5,000 tons, and there were no exports through Poti for Uzbekistan at all.

After the Russian invasion of Ukraine, import volumes increased by almost 7 times compared to 2020. Imports are mainly sugar.

As for exports, fertilizers are exported from Uzbekistan through Poti.

If we take the changes in relation to the Middle Corridor or inter-regional trade, then, from the point of view of the port authorities,

There is a growing interest in using Poti as a hub for the transport of goods to and from all Central Asian countries, and as coordination improves between the various parties involved in the transnational supply chain, this trend will continue to grow.

Timur Abdullayev , restaurateur, founder of the Uzbek -Georgian trading house and representative of the Chamber of Commerce and Industry of Uzbekistan in Georgia

The most demanded areas of investment in Georgia for Uzbekistan- this is an investment in the tourism sector , IT , agriculture. Foreign direct investment from Uzbekistan in investment property in Batumi . The Uzbeks are also interested in a certain area related to logistics at the Poti airport . Uzbek investors also invested in a solar panel plant in Kutaisi and to a non-starting electric car factory in Kutaisi.

How many transactions between Georgia and Uzbekistan in 2022 and in the first quarter of 2023

As for the transactions that worked, there are no more than 10 such companies that I brought to the Uzbek market over the past year . Because the processes are difficult at many points. Negotiations are underway. The market is such a thing . If the proposal is uninteresting, if there is an alternative , then projects may not be launched . Both in Uzbekistan and general projects. But the processes are daily, they go. Most importantly, there is an interest of Georgian companies in Uzbekistan.

Import of Georgian wine

Import of wine with my direct participation began last year. These are 4 companies. The total amount of the first contracts was in the region of 50,000 US dollars. Of the 4 companies, two showed very good sales results. Accordingly, new deliveries of wines from these companies are planned for the next month . And plus, there is interest not only in large wholesale deliveries, but also there is an interest in buying niche wine from Georgian producers who make wine in small volumes. An exclusive niche wine of amazing quality, which must also be presented in Uzbekistan , given the growing interest in the wine culture and in the use of wine drinking in general.

I hope that trade and economic relations between the two countries will only increase. There are areas where Georgian companies are interested, since Uzbekistan as a whole is a tasty morsel as a sales market. And Georgia, accordingly, attracts Uzbeks as a resort country and investment property.

TBC bank Uzbekistan – FDI in Uzbekistan’s digital finance is highly profitable, reports show

In April 2020, TBC Bank was the first to be registered as a digital bank in Uzbekistan, which stimulated the development of digital banking in the country. In Uzbekistan, the bank launched on the basis of the innovative fintech platform Space , owned by TBC Bank Group PLC, providing retail banking solutions through a mobile application. Commercial activity began in December 2020 when “TBC Credit” was launched.

In April 2023, for the first time since the start of operations, the bank reported on its profit.

In the first quarter of this year, the bank’s income more than tripled, loan payments quadrupled.

Income of TBC Bank Uzbekistan for the first quarter amounted to 212.54 billion soums , according to a report on the Unified Corporate Information Portal.

Compared to the same period in 2022, they increased by 3.34 times – then they amounted to only 63.6 billion soums . Calculations hereinafter are given according to the national reporting standards of the Republic of Uzbekistan.

Number of issuers BY YEAR

The bank’s net income amounted to 51.18 billion soums – against a loss of 8.57 billion soums a year earlier. 47.29 billion spent on operating expenses soums , of which more than half were the salaries of employees.

At the end of the quarter, TBC net profit amounted to 3.89 billion soums . A year ago, in the first quarter, the bank incurred 49.2 billion amount of loss.

The bank’s assets over the past year more than tripled to 2.74 trillion soums . At the same time, liabilities showed a slightly smaller increase and amounted to 1.85 trillion soums .

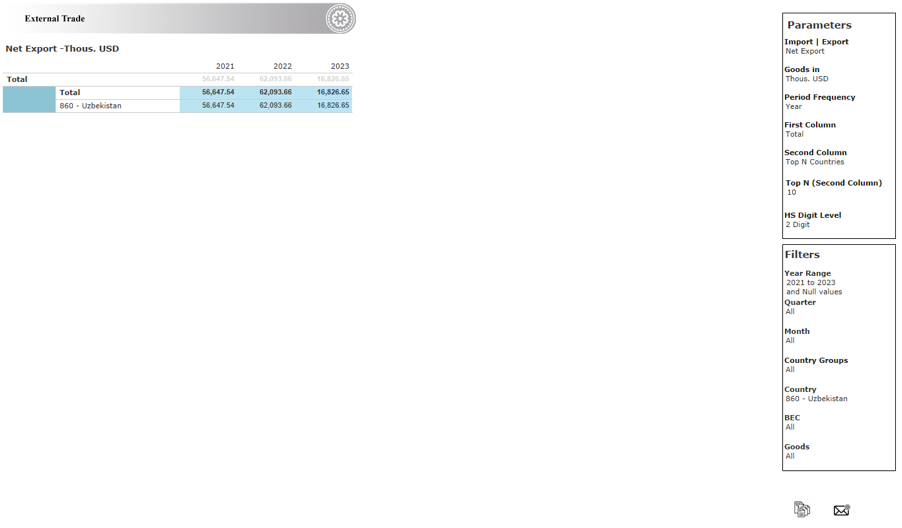

Trade turnover

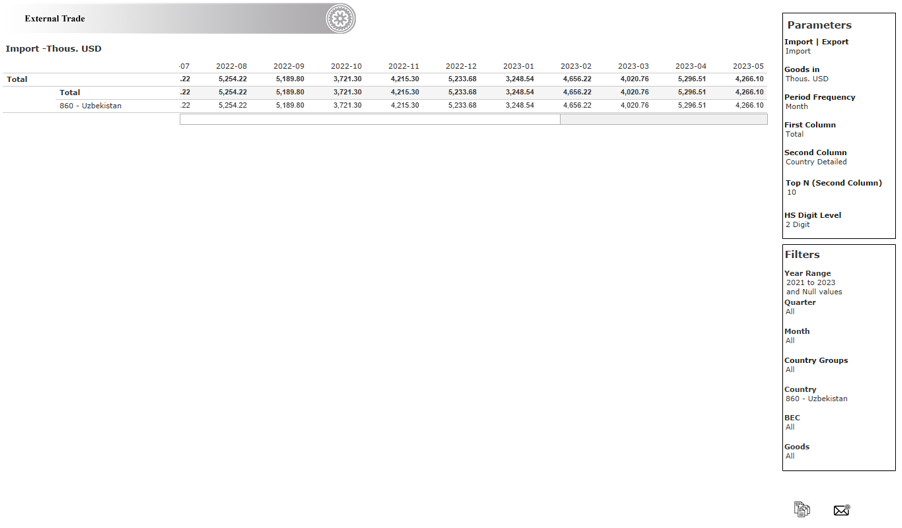

Import volume difference of Georgia from Uzbekistan

As for Georgia’s imports from Uzbekistan, its growth is reflected in the following chart of the Central Bank of Georgia

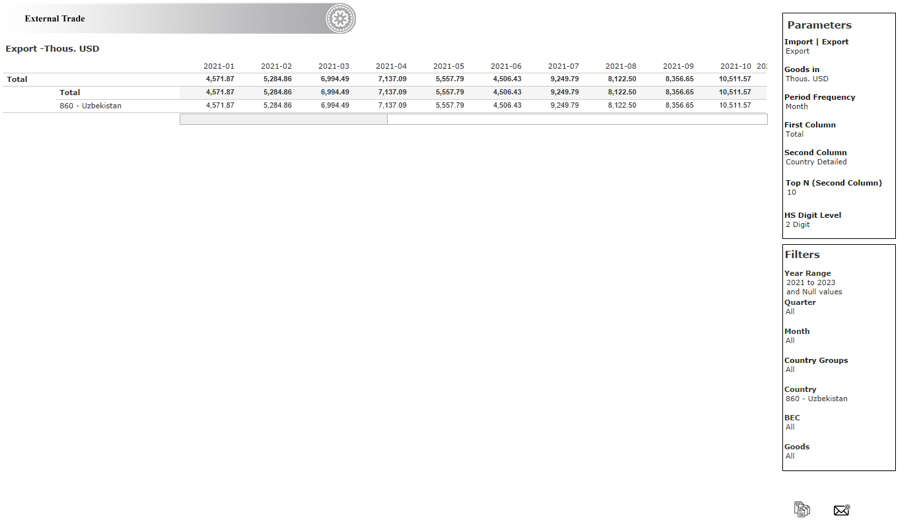

Export dynamics is reflected by the following data of the Central Bank of Georgia

net exports to Uzbekistan amounted to

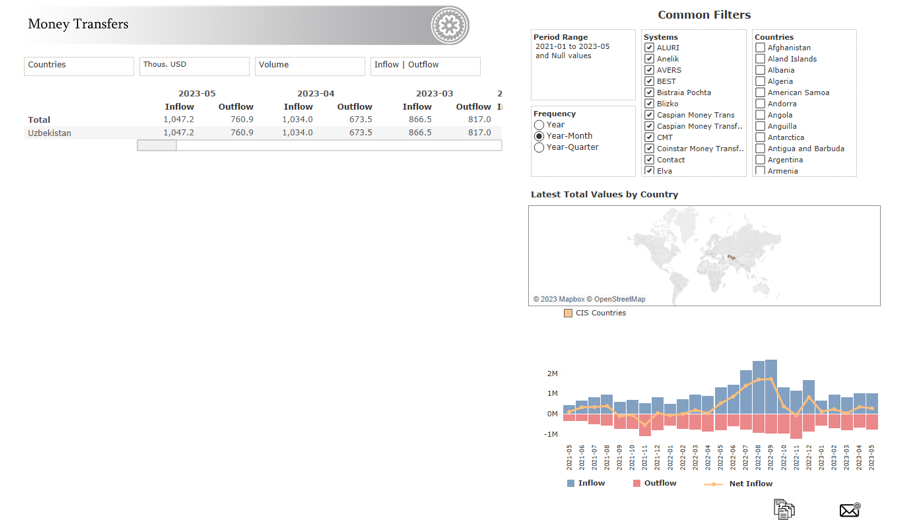

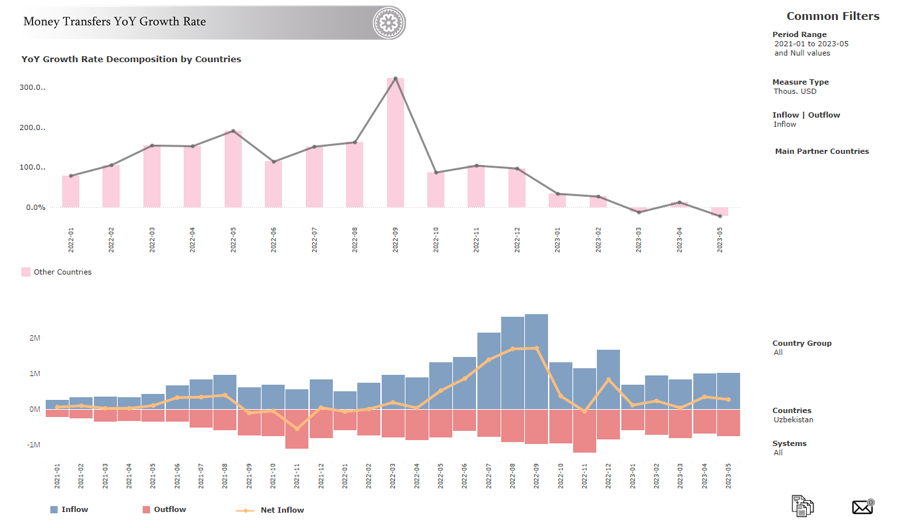

The volume of remittances between Uzbekistan and Georgia also continues to grow steadily after the start of the war between Russia and Ukraine.

The growth in the volume of money transfers between Georgia and Uzbekistan reflects the following schedule of the Central Bank

As we can see from the graph, after the outbreak of the war, the volume of remittances only grows. Moreover, it reaches its maximum jump at the moment when mobilizations are announced, etc.

How the war between Russia and Ukraine affected the investment attractiveness of Georgia

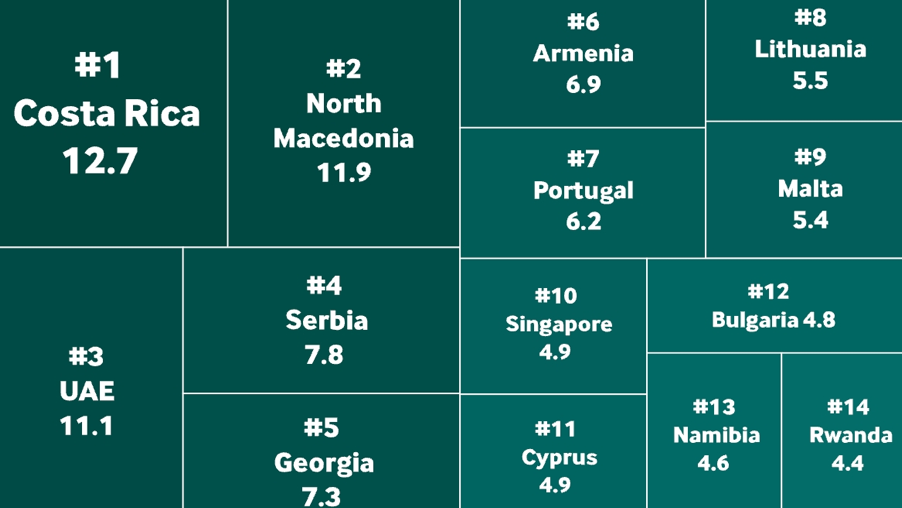

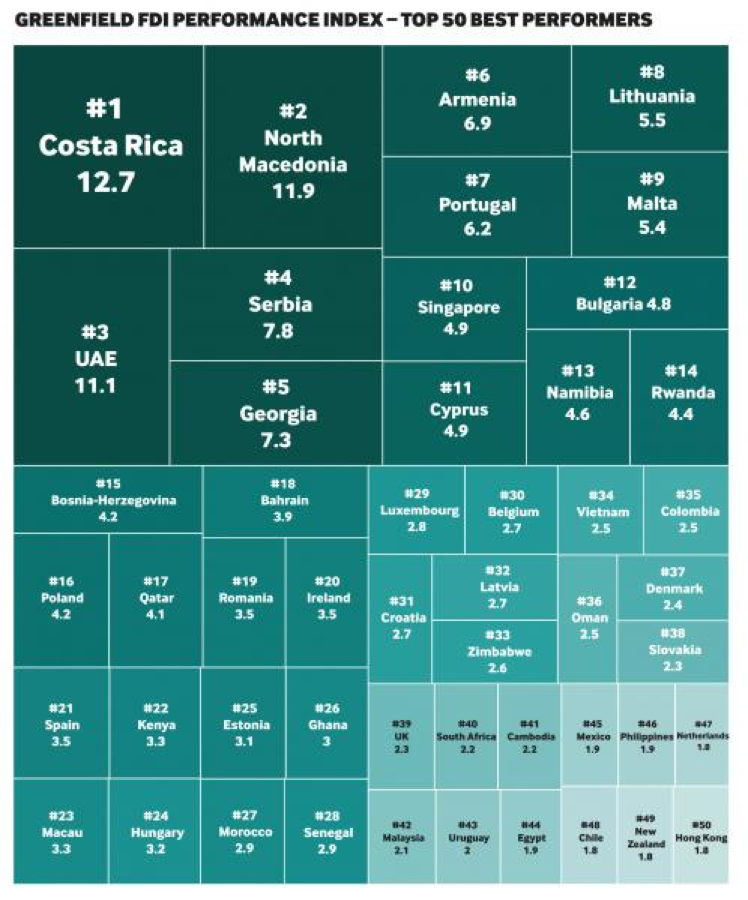

Georgia ranks fifth in the world in terms of foreign direct investment to GDP ratio.

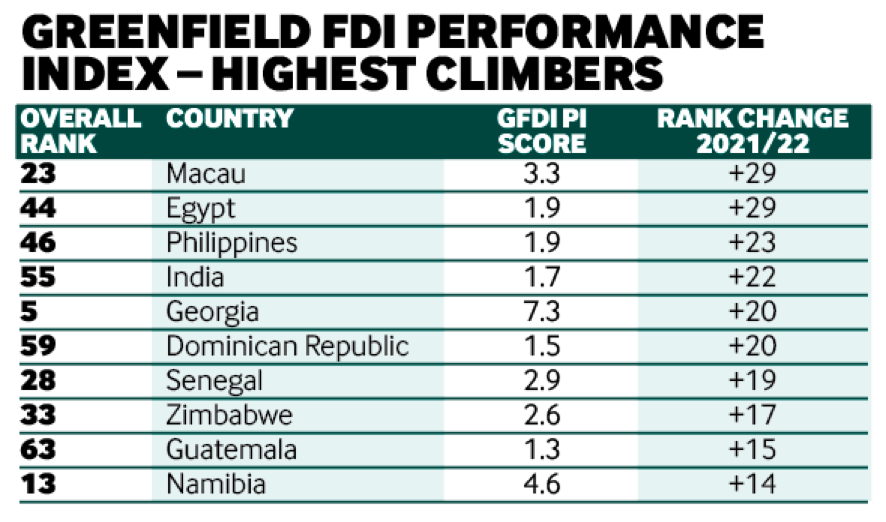

The fDi Intelligence research center has published a rating that analyzes data from 95 countries. The center is part of the Financial Times group, one of the most influential business media holdings in the world.

Georgia recorded the highest growth in the number of projects relative to GDP, from eight in 2021 to 32 in 2022, while its GDP increased from $19 billion to $25 billion. Foreign direct investment reached $2 billion. The number of foreign investors has doubled.

In the first quarter of 2023, FDI amounted to $496.6 million. This is 13.7% less than the preliminary data for the 1st quarter of 2022, but 53.3% more than the parameters for the 4th quarter of 2022.

The most powerful growth according to the fDi Intelligence rating

In total, six countries moved up more than 20 positions, with the Philippines moving up 23 places, India up 22 and Georgia up 20.

Real estate investment

In the first quarter of 2023, home sales in Batumi grew by 40% year on year. For 15 months, foreigners have purchased more than 20,000 apartments in Georgia. Among foreign buyers there were also citizens of Russia, Israel, Ukraine, Uzbekistan and other states.

The fDi Intelligence study notes that Georgia has entered the TOP-10 of the international FDI Performance Index, and in relation to GDP, the top five countries with the best performance.

Conclusion

Trade and economic relations between Georgia and Uzbekistan is an extremely promising industry. In April, a regular meeting of the Uzbek-Georgian Intergovernmental Commission on Trade and Economic Cooperation was held in Tashkent under the chairmanship of Deputy Prime Minister Jamshid Khodjaev and Deputy Prime Minister, Minister of Economy and Sustainable Development of Georgia Levan Davitashvili.

The parties stressed the relevance of establishing industrial cooperation. The meeting considered the potential for the implementation of joint projects in the areas of production of advanced pharmaceuticals, agricultural products, mineral fertilizers, as well as the creation of clusters for the production of alcoholic beverages.

The parties paid special attention to the development of transport and logistics partnership, in particular, the expansion of the use of the Baku-Tbilisi-Kars transport corridor and the developed Black Sea port infrastructure of Georgia.

Again, I would like to return to the fact that in Uzbekistan investors from Georgia occupy only the third place after investors from Russia and Kazakhstan, their shares are 0.5% against 98.2% and 0.95%, respectively. However, one of the largest investments in banking and fintech by the CIS countries in Uzbekistan comes from Georgia, and is a 51 percent banking subsidiary with equity already reaching 45 million US dollars, which was opened in Tashkent in 2020 Georgian TBC Bank.

Uzbekistan and Georgia signed an agreement on cooperation in the field of technical regulation, standardization, metrology and conformity assessment, as well as a Protocol on the completion of bilateral negotiations on access to the market for goods and services between Georgia and the Republic of Uzbekistan as part of the accession of the Republic of Uzbekistan to the World Trade Organization (WTO) ).

Georgia, in general, demonstrates successful development. GDP in 2022 exceeded 10%, in January-February 2023, foreign trade turnover increased by 12%, and exports by 20%. Among the export goods, cars were in the lead (including to Uzbekistan, as we wrote above, through the port of Poti), copper ore, concentrates and ferroalloys. Automobiles were also the main imports, followed by gas and oil.

Apparently, the mutual interest in trade and economic relations between Uzbekistan and Georgia will only grow.