What caused the collapse of Turkish lira - political or economic reasons?

What caused the collapse of the Turkish lira?

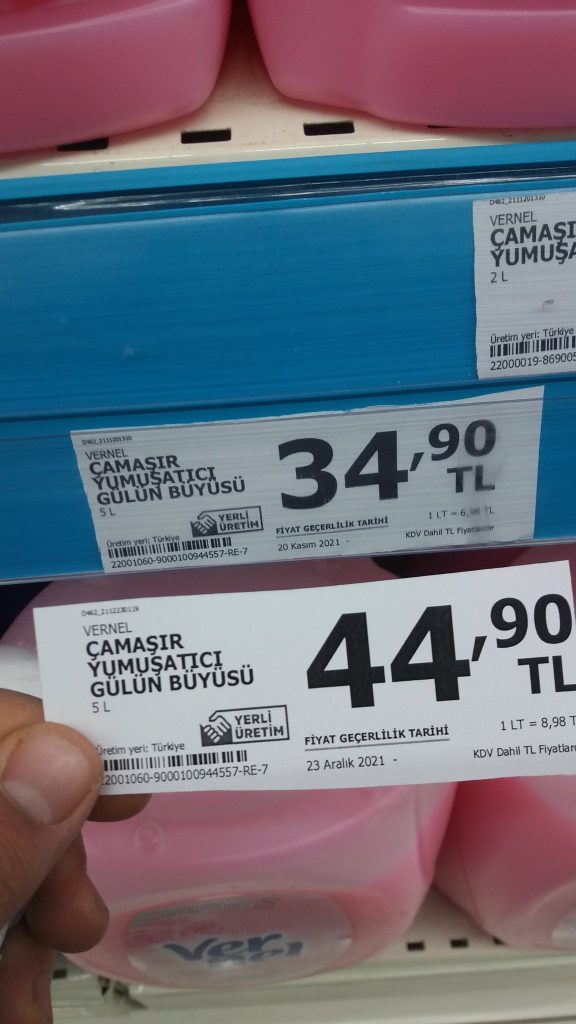

Last week, the sharp rise of the US dollar against Turkish lira, as well as the daily rise in prices for almost all goods in Turkey led to a tense economic situation in the country. Subsequently, the steps taken by the government slightly reduced the dollar rate, but the rise in prices did not stop.

- Erdogan’s government about to face a trial by lira

- Op-ed: Turkey is searching for an ‘external enemy’

- Syrian, Afghan refugee crisis hits Turkey amid Taliban takeover

For more than three years now, Turkey has been experiencing economic problems due to periodic falls in the national currency – the Turkish lira- against major world currencies.

On the eve of the parliamentary elections in June 2018, the US dollar exchange rate in Turkey was only 4.75 lira, but three months later it increased to 7 lira, and in subsequent periods, with short interruptions, rose to 8, 9 and even 17 lira per dollar.

At present, after certain steps by the Turkish government, the dollar exchange rate has stabilized in the range of 11-13 Turkish lira.

Why is the lira losing value?

In the early years of the Justice and Development Party (AKP), the Turkish economy developed quite successfully and became one of the fastest growing in the world. The first problem with foreign exchange rates in the country arose immediately after the declaration of the state of emergency as a result of an unsuccessful coup attempt on July 15, 2016.

The situation of the country’s economy became especially alarming in the beginning of 2018. The dollar rose sharply for the first time since the AKP came to power, and, by March of that year, exceeded the four lira mark.

The main reason for this was not economic, but political factors.

Brunson factor in relations between Turkey and the United States

At that time, a diplomatic crisis arose between Turkey and the United States in connection with the arrest of American evangelist Andrew Brunson.

A preacher from America was arrested in Turkey on charges of espionage, and, on April 19, 2018, during his speech, US President Donald Trump warned Ankara about the possible consequences.

A month later, Erdogan’s government rejected the US demand for the extradition of the religious leader. The American authorities reacted to this by denying the supply of F-35 fighters, for which Turkey was already paying. To this day, these military aircraft have not yet been delivered.

In August 2018, Washington imposed sanctions on two Turkish ministers, a measure that hit the Turkish lira hard.

On August 3, 2018, the US dollar exchange rate, for the first time since 2001, passed the 5 Turkish lira milestone and began to grow rapidly. So, a week later, the US dollar was sold for 6 lira, and on August 12 – for more than 7 lira.

Only after that, the Turkish government was forced to yield on the Andrew Brunson issue and, after completing some legal formalities, the evangelist was released in October 2018.

This slightly eased the pressure on the Turkish currency and its rate stabilized.

Erdogan government’s intervention

The main reason for the further crisis of the Turkish lira was the statements of the country’s President Recep Tayyip Erdogan about the link between the central bank’s discount rate and inflation.

In his speeches, the chairman of the ruling party and Turkish President Erdogan linked the annual inflation reaching 20%, with the fact that the central bank’s interest rates were unjustifiably high. This vision of affairs has become a “bone of contention” between the leadership of the Central Bank of Turkey and the president. As a result, in less than three years the chairmen and deputy chairmen of the country’s Central Bank have changed four times.

In March 2021, at the initiative of the chairman of the central bank of Turkey, Naji Agbala, the discount rate was increased to 19% and the US dollar rate dropped to 7.3 lira overnight.

But a few days later, by order of Erdogan, the chairman of the Central Bank was removed from office. This led to another crisis with foreign exchange rates. Thus, in a short time, the rate of the American currency rose to 8.5 Turkish lira.

Unable to overcome the problem with inflation, the Erdogan government, starting from September 2021, resorted to radical financial policies. From August to December this year, the Central Bank’s discount rate fell from 19 to 14%.

At the same time, the Turkish lira has experienced the worst decline in the past 20 years.

On November 9, the US dollar exchange rate exceeded the mark of 9, November 12 – 10, November 18 – 11 Turkish lira. The growth of the American currency continued practically without stopping, and on December 20, 18 lira was given for 1 US dollar in Turkey.

Tough measures of the government

Only after this shock did Erdogan and his government decide on introducing tough economic measures.

On December 21, the President of the country announced a new economic program. The Turkish authorities, promised to protect investments in the national currency in order to avoid the outflow of foreign investors from the country.

Under the new rules, investors who have lost their funds as a result of the rise in prices for foreign currencies will receive compensation from the central bank of Turkey. Simply put, if the growth of the dollar rate exceeds the discount rate of the Central Bank, the difference will be paid at the expense of the country’s state budget.

As soon as Erdogan finished his speech, the dollar began to fall at a fantastic rate. In just one night, it dropped from 18 to 13 lira, and in the following days it dropped back to 11 Turkish lira.

However, according to economists, this decision does not bode well for the country’s economy. Prominent economist Ozgur Demirtash noted that Erdogan’s decision is an unofficial and limitless increase in the central bank’s discount rate. He is confident that in order to compensate for the money that investors will lose due to the growth of foreign currencies, the authorities will simply have to print new banknotes, which will lead to even greater inflation.

Economist Mustafa Sonmez shares Demirtas’ point of view. He also said that by its decision the government will secretly raise the discount rate and this will become an additional burden for the state budget.

Among other things, everyone in Turkey is now expecting a decline in prices, which rose in parallel with the rise in the dollar against the Turkish lira. However, local media reports that the fall in the dollar rate has not affected the wholesale and retail prices of goods in any way.