The Georgian economy is increasingly dependent on Russia. Numbers and analysis

Dependence of the Georgian economy on Russia

After February 24, 2022, the beginning of Russian aggression in Ukraine, Georgia’s economic dependence on Russia has increased significantly. In foreign trade turnover, tourism and remittances, both financial and percentage increases are noted. Despite the decline in the birth rate and mass emigration, due to the mass arrival of Russian citizens who have become migrants, the population of Georgia even increased last year.

International trade

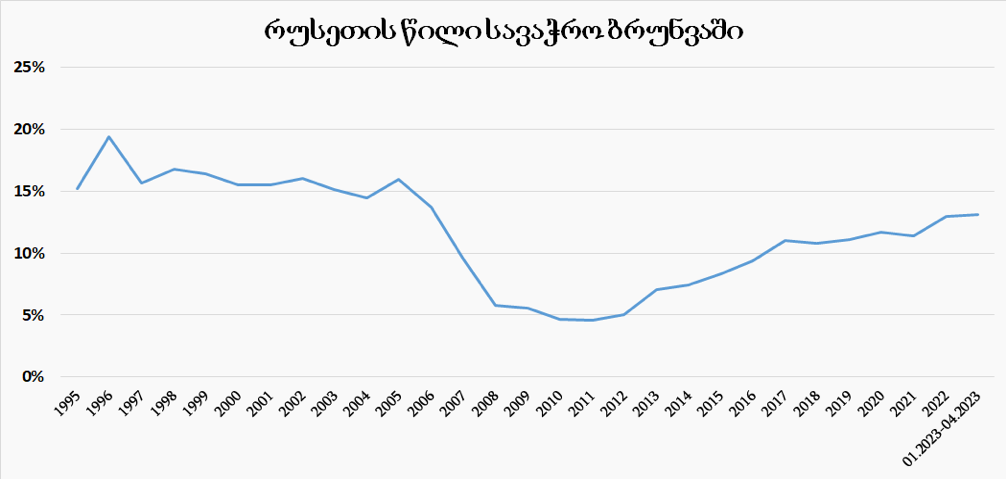

After gaining independence, Russia, as a familiar market, became Georgia’s main trading partner – before the embargo of 2006, its share in the trade turnover steadily exceeded 15 percent, after the embargo it fell below five percent. In 2022-2023, it again exceeded 13 percent.

Over the 10 months since the beginning of the war, compared to the same period of the previous year, foreign trade turnover with Russia increased by 54.4 percent (including exports by 3.2 percent and imports by 85.5 percent).

The trend continued in 2023, with the difference that in the first four months exports also increased significantly by 44.6 percent, to which was added an increase in imports by 54.2 percent. In January-April, trade with the whole world increased by 21.9 percent (from $5 billion 254 million to $6 billion 493 million), and with Russia separately by 51.4 percent (from $560 million to $848 million).

In individual exports, Russia’s share in January-April 2022 was 9.9 percent, and in January-April 2023 – 11.5 percent. In total, over four months Georgia sold products worth $226 million to Russia.

The 11.5% dependence on exports in Russia is generally not small, but it is not considered particularly high either.

The problem arises when breaking down into individual products. For example, 67 percent of wine exports go to Russia, 57 percent of mineral waters, and 53 percent of ferro-alloys are also exported to Russia.

After the embargo was lifted in 2013, although most of the wine still went to Russia, there was no such serious dependence. Even in 2021, Russia’s share in wine exports was 55 percent.

It is in Russia that the most Georgian wine is sold, but it is cheaper there than in other countries, or even much cheaper. According to data for four months, the export price of one liter of Georgian wine in Russia was $2.75, in the European Union $3.16, in the USA $6.58. In other CIS countries, except for Russia, it is $3.08.

It is risky to count on such a scale, other things being equal, even if it is not an occupying state. In the case of Russia, however, this risk, even taking into account only the experience of the 2006 embargo, is incomparably higher.

In both 2022 and 2023, imports increased more than exports, in which the switch to Russian oil products was the decisive factor. Given the sanctions, Russia is forced to make a significant discount on its main export product – energy.

If earlier Russia was an ordinary fuel supplier for Georgia, then in January-April 2023, its share in the import of gasoline and diesel fuel increased to 85 percent.

Natural gas imports also increased sharply, by 116 percent, from $37 million to $80 million.

It should be fully commercial gas, because Georgia buys natural gas for the population and heating points from Azerbaijan. Large enterprises have the right to choose an alternative supplier for the purchase of commercial gas, and Russia is the only such supplier in the region.

Unlike fuel, imports of other products have not increased as much, although there remains a very high 96 percent dependence on Russia’s share of flour and wheat imports.

With an increase in foreign trade turnover with Russia, according to data for January-April, exports to China fell sharply (by 44 percent). China ranked first among export partners in 2020-2022, today it is fifth.

The decline in the share of exports is much more dramatic in the case of the United States. Here, exports fell 79 percent in four months.

Exports to the European Union increased, albeit slightly by only 5.5 percent. Despite the growth in the money supply, the share of the EU in exports fell to 14.8 percent. If this trend continues in the next eight months, it will be the lowest since 1997.

It should also be taken into account that the US is the number one economy in the world, China is the second, and the European Union as a single market is the third. Together these three countries produce 60 percent of the planet’s economy, which is 30 times more than Russia alone.

Tourism/Migration

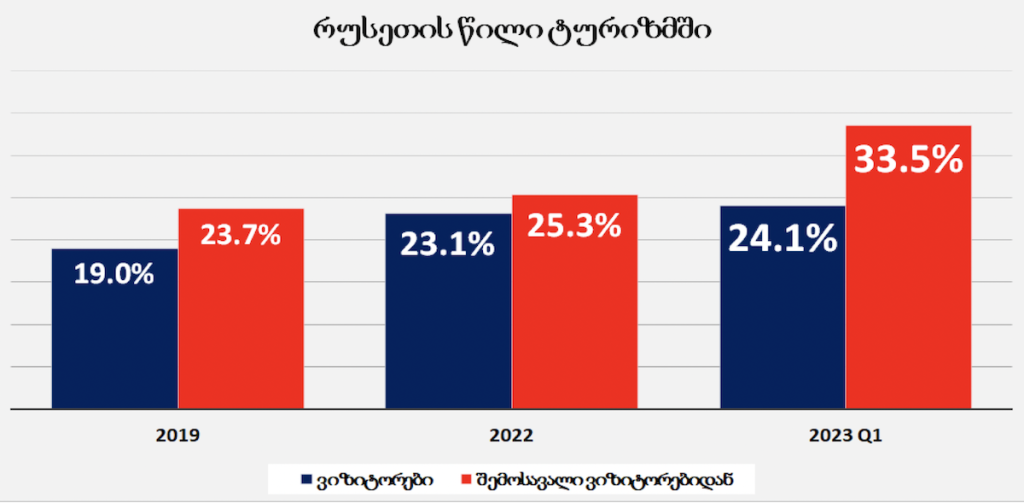

Foreign trade is not the only area where Georgia’s dependence on Russia has grown. This also applies to the tourism segment. Moreover, given that part of the tourists turned out to be migrants and remained in Georgia, this topic is even more remarkable.

In 2019, the share of Russian citizens in the total number of visitors was 19 percent, in 2023 – 24.1 percent. The income that Russian visitors leave in Georgia has also grown. In terms of income, Russia’s share increased from 23.7 percent to 33.5 percent between 2019 and 2023.

According to the National Statistics Service of Georgia, in 2022 the balance of migration from Russia exceeded 56 thousand people, which became the main determining factor in population growth, despite the negative balance of migration and the negative natural increase of Georgian citizens.

Migration has also affected the real estate market.

For 15 months Russians purchased 8,249 apartments, 3,958 land plots, 766 non-residential and 178 commercial premises.

Since May 19, after an almost four-year hiatus, direct flights between Russia and Georgia have been resumed. The emergence of additional opportunities will push the number of visitors to increase, but it is impossible to determine in advance by how much.

Dependence of the Georgian economy on Russia

Money transfers

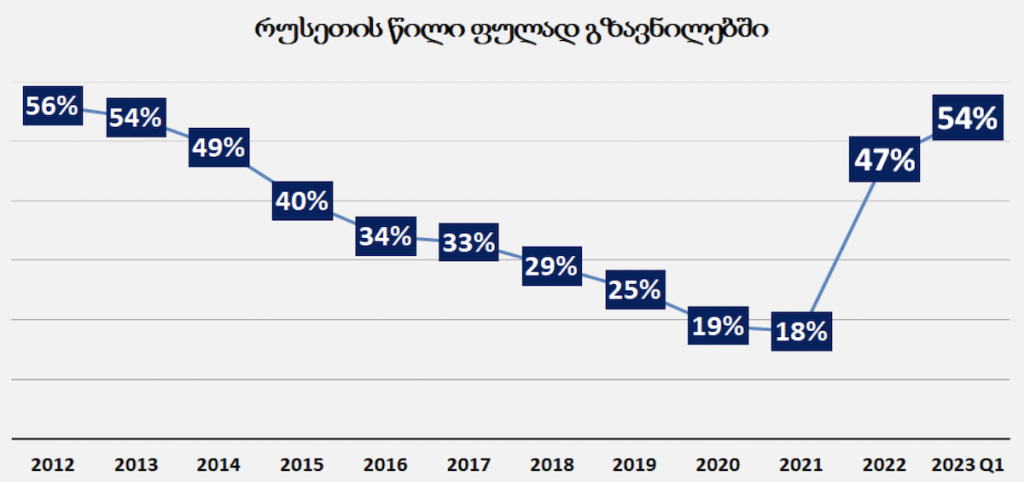

Remittances have always played a big role in the economy of Georgia as a small poor country. From year to year the volume of remittances increased, and its structure also changed. If in 2012 Russia’s share in remittances was 56 percent, then in 2021 it fell to 18 percent. However, it increased to 47 percent in 2022 and to 54 percent in the first quarter of 2023.

In 2022 four billion 372 million dollars were transferred to the country in the form of money transfers, which is two billion dollars more than in 2021.

Growth rates continued into early 2023. Some Russian citizens brought money into the country in the form of cash. The main reason for the strengthening of the lari was the increase in cash flows from Russia, and if it were not for the purchase by the National Bank of more than one billion dollars to replenish reserves, the value of the dollar would now be much lower.

Dependence of the Georgian economy on Russia

Risks and Opportunities

The growth of economic relations with Russia, including the agreement to restore air traffic, despite political and economic risks, does not mean a violation of sanctions in the literal sense.

If we look at the export statistics, we will not find sanctioned products in it from March 2022 to April 2023, a similar fact was not confirmed at the customs at the Upper Lars checkpoint. Despite the fact that no specific violation of sanctions has yet been identified, the risks are increasing. The EU is working on an 11th round of sanctions aimed at filling existing loopholes and blocking workarounds.

Certain attention-grabbing signals in this direction are coming towards Georgia and from the West.

According to the influential American publication Politico, US State Department sanctions coordinator Jim O’Brien said that Russia managed to restore imports of microchips and electronic equipment to pre-war levels. O’Brien noted that “the problem of sanctions evasion is created” by Georgia, Armenia, Turkey, the United Arab Emirates and Kazakhstan.

This is not yet an official statement, but it may contain some warning signs.

In international media – The New York Times, CNBC – such accusations have been made before. But then the conclusions were based on the growth of trade and the queues of trucks on Upper Lars. But only these data (an increase in the export of illegal products) could not be the reason for any serious decision on the part of official structures.

In addition to the increased threat of direct sanctions from the West, there are also political factors damaging Georgia’s image.

However, it seems that reputation is not so important for the ruling Georgian Dream party in Georgia. The Georgian government explains the deepening of relations with Russia by concern for its citizens and spreads the narrative through propaganda channels that the West wants to drag Georgia into the war. It is also constantly said that the Georgian economy will be overtaken by problems if relations with Russia are not improved.

For example, Georgian Dream published a quote from Irakli Kobakhidze, chairman of the ruling party. He argues that if new sanctions against Russia are introduced, the Georgian economy will shrink by 10-18 percent instead of the current 10 percent growth.

A complete severance of economic relations with Russia will certainly slow down Georgia’s economic growth. How exactly is hard to say. In 2009, a year after the 2008 war, during the global economic crisis in Georgia, the drop was 3.7 percent. In 2020, during the pandemic, the drop was 6.8 percent. But before that Georgia weathered the 2006-2007 embargo more easily, found alternative markets, and even broke a record of economic growth in 2007. (The 12.6 percent increase recorded in 2007 remains a record 16 years later.) Global growth is slowing today and the same will need to be repeated, although the 10 and 18 percent downside scenarios also seem unrealistic.

Dependence of the Georgian economy on Russia

Territorial proximity to Russia and a long-familiar market – these are the circumstances that work. But there is also the fact that the Russian economy is less than two percent of the planet’s economy. No country politically or economically dependent on Russia is rich or developed.

There is no reason to fear that if Russia bans exports, then Georgia will run out of bread and gasoline – they will be imported from other countries. The price will rise, but the threat of a shortage is virtually eliminated. Azerbaijan remains the main supplier of natural gas to Georgia.

Unlike imports, export substitution is much more complicated and takes more time. For Russia, if it wants to, it is easy to find an excuse for an embargo – in the event of a new embargo, the government will either have to increase subsidies or endure the protests of disgruntled winegrowers.

Emotions aside, by rational calculation, increased economic dependence on Russia means mired in poverty in the long run.

Dependence of the Georgian economy on Russia